Introduction:- Tata Power Share Price Target

Tata Power, part of the renowned Tata Group, stands as one of India’s largest integrated power companies. Established in 1915, Tata Power has a rich history and a diverse portfolio that includes traditional power generation, renewable energy, and power distribution. The company’s vision is to provide reliable and sustainable energy solutions, driving innovation and growth in the energy sector.

Tata Power Company Ltd is a significant player in the energy industry, known for its comprehe

nsive activities in generating, transmitting, and distributing electricity. As India’s foremost vertically-integrated power company, Tata Power is dedicated to advancing renewable energy and plays a crucial role in achieving the country’s sustainable energy objectives.

Tata Power, a leading player in India’s power sector, has garnered significant attention from investors due to its ambitious expansion plans in renewable energy and electric vehicle infrastructure. The company’s stock price has experienced substantial fluctuations in recent years, fueled by a combination of factors, including financial performance, regulatory changes, and broader market trends.

This blog provides a detailed analysis of Tata Power’s share price targets, examining factors such as company performance, industry trends, and economic conditions. Additionally, we will offer expert insights and opinions to make this analysis valuable and engaging for investors.

Key Business Segments of Tata Power’s company Limited

- Traditional Power Generation: Tata Power operates several thermal power plants across India. These plants use coal, gas, and oil to generate electricity, contributing significantly to the national grid. The company’s thermal power plants are located in various states, including Maharashtra, Gujarat, and Jharkhand.

- Renewable Energy: Recognizing the global shift towards sustainable energy, Tata Power has made substantial investments in renewable energy sources. The company has established a strong presence in solar, wind, and hydroelectric power. Notably, Tata Power Solar, a subsidiary, is one of the leading solar power companies in India, focusing on both large-scale projects and residential solar solutions.

- Distribution and Transmission: Tata Power provides electricity to millions of consumers in Mumbai, Delhi, and Odisha. The company’s distribution business emphasizes improving efficiency and reliability through advanced grid technologies and infrastructure upgrades.

- Emerging Technologies: Tata Power is exploring new technologies such as battery storage systems, electric vehicle (EV) charging infrastructure, and microgrids. These initiatives aim to enhance energy efficiency, reliability, and sustainability.

Key Highlights of Tata Power’s company Limited

1. Diverse Power Portfolio

By the first half of FY24, Tata Power’s energy capacity stood at an impressive 14,381 MW. This capacity includes a mix of thermal (8,860 MW), wind (1,007 MW), hydro (880 MW), waste heat recovery/BFG (443 MW), and solar (3,191 MW). Additionally, the company is developing 3,760 MW of renewable capacity and has signed a memorandum of understanding for a 2.8 GW Pumped Hydro Project.

2. Installed Capacity Breakdown

| Energy Source | Percentage (%) |

| Solar | 22% |

| Wind | 7% |

| Waste Heat/BFG | 3% |

| Hydro | 6% |

| Thermal | 62% |

This energy mix highlights Tata Power’s strategy of balancing traditional and renewable energy sources.

3. Capacity Utilization for H1FY24

| Energy Source | Capacity Utilization (%) |

| Thermal | 77.2% |

| Mundra | 51% |

| Hydro | 45% |

| Wind | 28% |

| Solar | 23% |

4. Comprehensive Value Chain Presence

Tata Power operates across the entire energy value chain, from electricity generation (both thermal and renewable) to transmission and distribution. The company also offers EPC (Engineering, Procurement, and Construction) and O&M (Operations and Maintenance) services.

Expanding Retail Customer Base

With its recent acquisition in Odisha’s distribution business, Tata Power’s retail customer base has surged from approximately 3 million to about 12 million. The company operates 4,383 circuit kilometers (km) of transmission capacity, with an additional 906 km under development. It recently secured the Jalpura Khurja Power Transmission Limited project and Rajasthan Phase IV Part C, involving significant capital expenditures.

Other Ventures

Tata Power is also engaged in:

- Project management and infrastructure services

- Rooftop solar installations

- Electric vehicle (EV) charging stations

- Property development and leasing of oil tanks

Tata Power EZ Charge

Tata Power is the leading operator in India’s EV charging infrastructure, dominating the public charging segment with a 55% market share and an 85% share in home charger installations. The company has established EV charging points in over 442 cities.

Revenue Distribution for H1FY24

- Thermal, Hydro, and Coal: 32%

- Renewables: 14%

- Transmission/Distribution: 54%

Global Footprint

Tata Power has a notable international presence, including:

- Hydro projects in Georgia and Zambia with significant installed capacities

- A 26% stake in Bhutan’s Dagachhu hydro project

- Extensive coal mining operations in Indonesia

Upcoming Brownfield Projects

- Bhivpuri PSP: A 1,000 MW project set to commence by mid-2024, with completion targeted by the end of 2027, involving a capital expenditure of approximately Rs. 4,700 crore.

- Shirawta PSP: An 1,800 MW project starting mid-2024, expected to complete by the end of 2028, with an estimated cost of Rs. 7,850 crore.

Recent Developments

- Expansion in Renewable Energy: Tata Power continues to expand its renewable energy capacity. Recent projects include large-scale solar power installations in Rajasthan and wind power projects in Gujarat.

- Strategic Partnerships: The company has entered into partnerships with global firms like Siemens and Hitachi to enhance its technological capabilities and market reach. These collaborations focus on smart grid solutions, digital transformation, and advanced energy management systems.

- Financial Performance: Tata Power has shown strong financial performance, with consistent revenue growth and effective cost management. The company’s focus on operational efficiency and strategic investments has resulted in improved profit margins and a robust balance sheet.

Tata Power Share Price target with Future Prospects

Tata Power Share Price target 2024:

| Target Level | Tata Power’s Share Price Targets | Second Target Price (INR) | Higher Expected Level (INR) | Lower Expected Level (INR) |

| 1st Level Target | Tata Power’s Share Price Targets 2024 | 400 | 424 | 376 |

| 2nd Level Target | Tata Power’s Share Price Targets 2024 | 420 | 445 | 395 |

Future Prospects: In 2024, Tata Power is expected to consolidate its position in the renewable energy sector. Increased government support for green energy projects and a growing focus on electric vehicles could drive share prices upwards. The company’s expansion into solar rooftop installations and energy storage solutions may also contribute to growth.

Tata Power Share Price target 2025:

| Target Level | Tata Power’s Share Price Targets | Second Target Price (INR) | Higher Expected Level (INR) | Lower Expected Level (INR) |

| 1st Level Target | Tata Power’s Share Price Targets 2025 | 501 | 534 | 468 |

| 2nd Level Target | Tata Power’s Share Price Targets 2025 | 526 | 561 | 491 |

Future Prospects: By 2025, Tata Power’s aggressive investment in renewable energy capacity should start yielding significant returns. The company’s focus on expanding its distribution network and offering value-added services like smart metering and energy management solutions could further boost investor confidence.

Tata Power Share Price Target: 2026-2029:

| Target Level | Tata Power’s Share Price Targets | Second Target Price (INR) | Higher Expected Level (INR) | Lower Expected Level (INR) |

| 1st Level Target | Tata Power’s Share Price Targets 2026 | 613 | 654 | 572 |

| 2nd Level Target | Tata Power’s Share Price Targets 2026 | 644 | 687 | 601 |

| 1st Level Target | Tata Power’s Share Price Targets 2027 | 737 | 785 | 688 |

| 2nd Level Target | Tata Power’s Share Price Targets 2027 | 774 | 827 | 721 |

| 1st Level Target | Tata Power’s Share Price Targets 2028 | 875 | 931 | 819 |

| 2nd Level Target | Tata Power’s Share Price Targets 2028 | 919 | 979 | 859 |

| 1st Level Target | Tata Power’s Share Price Targets 2029 | 1023 | 1087 | 959 |

| 2nd Level Target | Tata Power’s Share Price Targets 2029 | 1074 | 1141 | 1006 |

Future Prospects: This period is likely to be marked by accelerated growth in India’s renewable energy sector. Tata Power, as a major player, stands to benefit immensely. The company’s ambitious plans for offshore wind farms and green hydrogen production could propel its share price to new heights. Additionally, increasing collaborations with international players for technological advancements may enhance its competitive advantage.

Tata Power Share Price Target 2030-35:

| Target Level | Tata Power’s Share Price Targets | Second Target Price (INR) | Higher Expected Level (INR) | Lower Expected Level (INR) |

| 1st Level Target | Tata Power’s Share Price Targets 2030 | 1182 | 1253 | 1111 |

| 2nd Level Target | Tata Power’s Share Price Targets 2030 | 1241 | 1316 | 1165 |

| 1st Level Target | Tata Power’s Share Price Targets 2031 | 1352 | 1430 | 1275 |

| 2nd Level Target | Tata Power’s Share Price Targets 2031 | 1419 | 1501 | 1337 |

| 1st Level Target | Tata Power’s Share Price Targets 2032 | 1535 | 1621 | 1449 |

| 2nd Level Target | Tata Power’s Share Price Targets 2032 | 1612 | 1703 | 1520 |

| 1st Level Target | Tata Power’s Share Price Targets 2033 | 1729 | 1822 | 1636 |

| 2nd Level Target | Tata Power’s Share Price Targets 2033 | 1815 | 1914 | 1717 |

| 1st Level Target | Tata Power’s Share Price Targets 2034 | 1939 | 2050 | 1828 |

| 2nd Level Target | Tata Power’s Share Price Targets 2034 | 2036 | 2143 | 1929 |

Future Prospects: In this timeframe, Tata Power could emerge as a global leader in renewable energy. India’s goal of achieving net-zero emissions will create a massive demand for clean energy solutions, driving Tata Power’s growth. The company’s focus on research and development, coupled with potential acquisitions of smaller renewable energy players, could further solidify its market position.

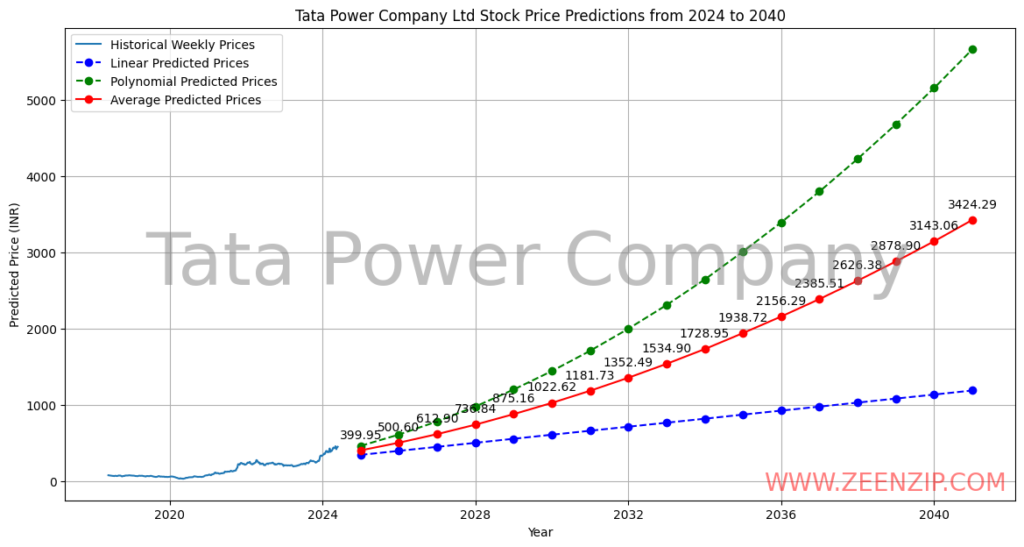

Tata Power Share Price target 2035-40:

| Target Level | Tata Power’s Share Price Targets | Second Target Price (INR) | Higher Expected Level (INR) | Lower Expected Level (INR) |

| 1st Level Target | Tata Power’s Share Price Targets 2035 | 2156 | 2277 | 2035 |

| 2nd Level Target | Tata Power’s Share Price Targets 2035 | 2264 | 2392 | 2137 |

| 1st Level Target | Tata Power’s Share Price Targets 2036 | 2386 | 2533 | 2238 |

| 2nd Level Target | Tata Power’s Share Price Targets 2036 | 2505 | 2649 | 2360 |

| 1st Level Target | Tata Power’s Share Price Targets 2037 | 2626 | 2788 | 2464 |

| 2nd Level Target | Tata Power’s Share Price Targets 2037 | 2758 | 2928 | 2587 |

| 1st Level Target | Tata Power’s Share Price Targets 2038 | 2879 | 3056 | 2701 |

| 2nd Level Target | Tata Power’s Share Price Targets 2038 | 3023 | 3208 | 2837 |

| 1st Level Target | Tata Power’s Share Price Targets 2039 | 3143 | 3338 | 2948 |

| 2nd Level Target | Tata Power’s Share Price Targets 2039 | 3300 | 3499 | 3100 |

| 1st Level Target | Tata Power’s Share Price Targets 2040 | 3424 | 3645 | 3204 |

| 2nd Level Target | Tata Power’s Share Price Targets 2040 | 3596 | 3823 | 3368 |

Future Prospects: By 2040, Tata Power is likely to be a dominant force in the global renewable energy landscape. Advancements in energy storage technologies and the widespread adoption of electric vehicles are expected to fuel the company’s growth. Tata Power’s focus on sustainability and its commitment to social responsibility could also attract a broader base of investors, further driving share prices upwards.

Disclaimer: Remember, these are just projections based on current trends and expert opinions. Stock market investments are inherently risky, and future performance is not guaranteed. Always conduct your own research and consult with a financial advisor before making investment decisions.

Also Read below important article also

- Jio Financial Services Share Price Target 2024-2040 : Comprehensive analysis

- https://stock.zeenzip.com/bpcl-share-price-target

Methodology for Price Target Prediction

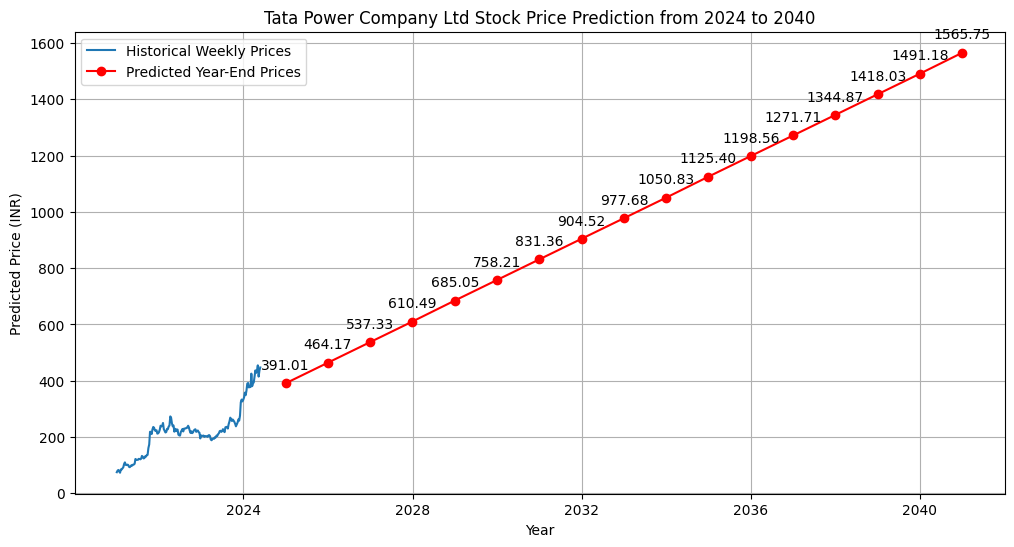

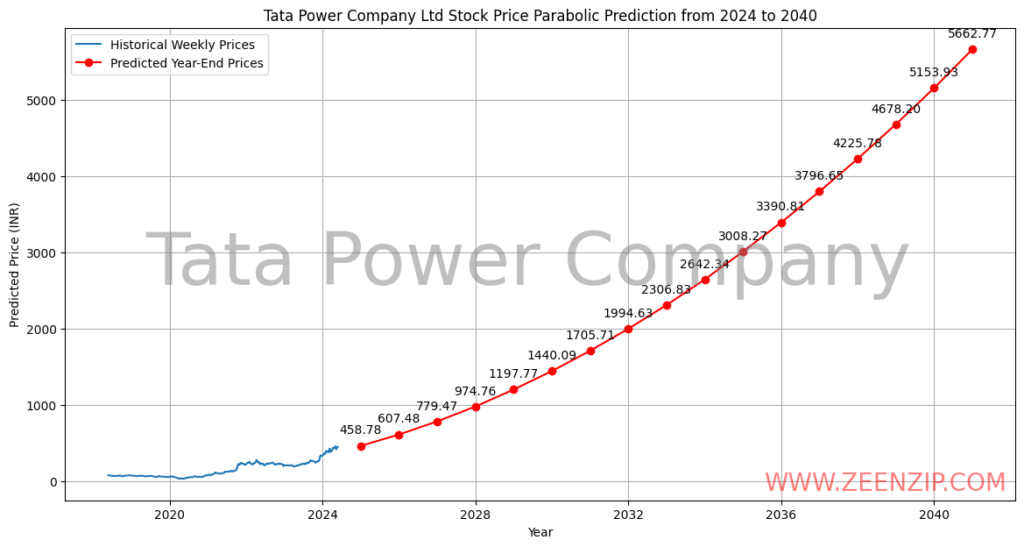

To predict Tata Power’s share price targets accurately, we use two primary methods: Linear Regression and Polynomial Regression. These methods help create a robust model that accounts for various factors influencing the stock price.

Linear Regression of price forcasting

Linear regression is a statistical method that models the relationship between a dependent variable and one or more independent variables using a straight line. This method is straightforward and effective for predicting trends based on historical data.

Polynomial Regression of price forecasting

Polynomial regression is a type of regression analysis where the relationship between the independent variable and the dependent variable is modelled as an nth degree polynomial. This method can capture more complex relationships and is useful for modelling non-linear data patterns.

Combining Methods of price forecasting for better Accuracy

To enhance the accuracy of our predictions, we calculate the average of the predictions obtained from both linear and polynomial regressions. This approach helps mitigate the limitations of each method, providing a more balanced and reliable forecast.

Target Price Levels

For each year, we generate two target prices with slight variations to account for market dynamics. Additionally, each target price has two levels: a higher expected level and a lower expected level, ensuring a comprehensive range of possible outcomes.

Factors Influencing Tata Power’s Stock Price

Several factors influence Tata Power’s stock price, ranging from company-specific performance indicators to broader industry trends and economic conditions. Understanding these factors can help investors make informed decisions.

Company Performance

Tata Power’s internal performance metrics are crucial in determining its stock price. Key performance indicators include:

- Revenue and Profit Growth: Steady growth in revenue and profit margins positively impacts investor confidence. For example, Tata Power’s revenue from operations increased by 15% in the latest financial year, driven by higher sales in the renewable energy segment.

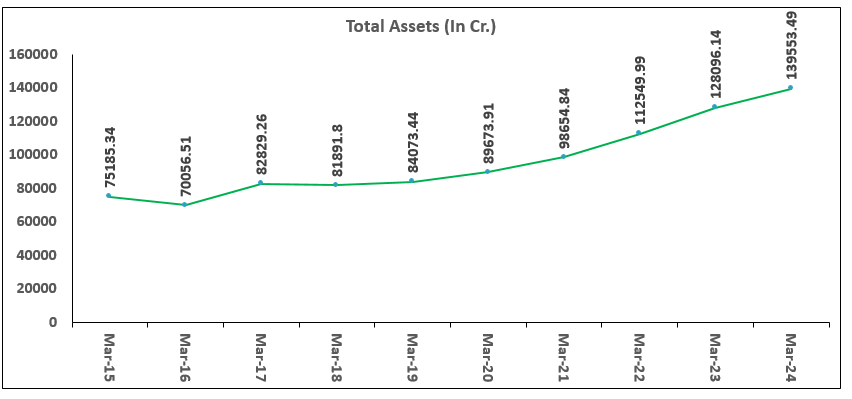

- Debt Levels: Effective management of debt levels is crucial for maintaining financial stability and investor trust. Tata Power has been actively reducing its debt through strategic divestments and refinancing, which has led to a stronger balance sheet.

- Dividend Payouts: Regular and attractive dividend payouts make the stock appealing to income-seeking investors. Tata Power has a history of paying consistent dividends, reflecting its strong cash flow generation and commitment to returning value to shareholders.

- Operational Efficiency: The company’s ability to manage costs and optimize operations directly impacts profitability. Tata Power has implemented various initiatives to improve operational efficiency, including the use of advanced analytics and digital tools to monitor and optimize plant performance.

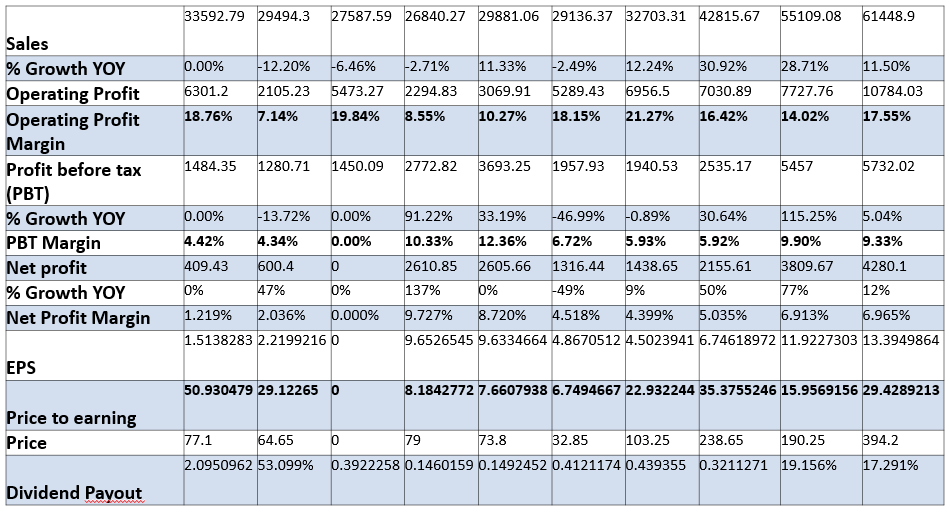

Study of Tata Power Balance sheet & Identification of Growth Prospect:-

Sales

- Growth Pattern:

- Significant drops in 2016 (-12.20%) and 2017 (-6.46%).

- Recovery starts in 2018, with a notable rebound in 2019 (11.33%).

- Robust growth from 2021 to 2023, with peaks in 2022 (30.92%) and 2023 (28.71%).

- Continued strong growth into 2024 (11.50%).

Key Takeaway: Tata Power’s sales experienced initial declines but recovered strongly post-2018, indicating effective growth strategies and increased market demand.

Operating Profit & Margin

- Operating Profit Margin Trends:

- Significant drop in 2016 (7.14%) from a high in 2015 (18.76%).

- Fluctuated with another high in 2017 (19.84%) and a peak in 2021 (21.27%).

- Stabilized around 14-17.55% from 2022 to 2024.

Key Takeaway: Operating margins have shown volatility but overall improvement, reflecting better cost control and operational efficiency.

Profit Before Tax (PBT) & Margin

- Growth and Margins:

- Decline in 2016 (-13.72%) and significant growth in 2018 (91.22%) and 2019 (33.19%).

- Sharp decline in 2020 (-46.99%) followed by a major rebound in 2022 (30.64%) and 2023 (115.25%).

Key Takeaway: PBT growth has been erratic with sharp declines and rebounds, showing the company’s struggle and recovery in managing pre-tax profits.

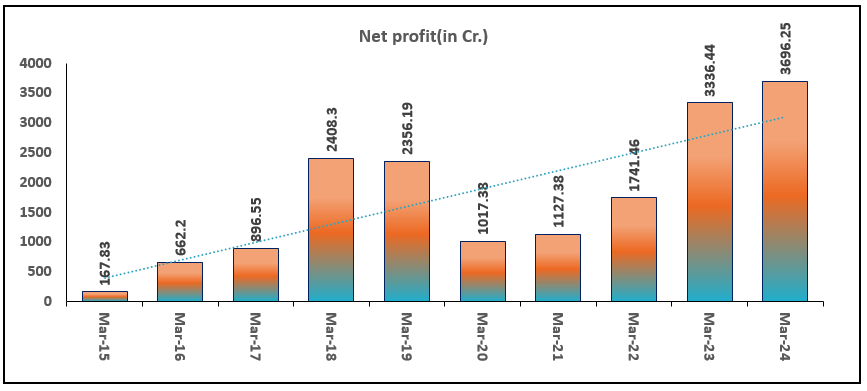

Net Profit & Margin

- Net Profit Margin Trends:

- Fluctuations with a high of 9.727% in 2018 and a recent improvement to 6.965% in 2024.

- Periods of zero profit (2017) and significant growth in recent years (2022: 50%, 2023: 77%).

Key Takeaway: Despite fluctuations, net profit margins have improved recently, reflecting better bottom-line profitability.

Earnings Per Share (EPS) & Price to Earnings (P/E) Ratio

- EPS Trends:

- Significant increase post-2018, especially from 2022 onwards, indicating higher profitability per share.

- P/E Ratio Trends:

- Volatility with a high of 35.38 in 2022 and a stabilization around 29.43 in 2024.

Key Takeaway: EPS and P/E ratio trends suggest increasing shareholder value and changing market sentiment towards the stock.

Dividend Pay-out

- Trends:

- Generally stable with recent significant increases, indicating higher returns to shareholders.

Key Takeaway: Consistent dividend payouts with recent increases show the company’s commitment to rewarding shareholders.

Trends Summary

- Sales Growth: Accelerated growth, especially in the last 3 years (23.40%).

- PBT Growth: Strong recent growth (43.48%) despite past volatility.

- PBT Margin: Steady improvement, reflecting better profitability management.

- Price to Earnings: Generally high, indicating robust market valuation.

Overall Key Takeaway: Tata Power has shown resilience and growth in recent years, with significant improvements in profitability, operational efficiency, and shareholder value. Despite some past challenges, the company’s financial health appears strong and on an upward trend.

Industry Trends

The energy sector is undergoing significant transformations, driven by technological advancements and regulatory changes. Tata Power’s ability to adapt to these trends influences its stock performance:

- Renewable Energy Transition: The global shift towards renewable energy sources benefits Tata Power due to its substantial investments in this area. Governments worldwide, including India, are setting ambitious targets for renewable energy capacity, providing a favourable environment for Tata Power’s growth.

- Regulatory Environment: Favourable government policies and subsidies for renewable energy projects can boost the company’s growth prospects. The Indian government’s initiatives, such as the National Solar Mission and incentives for wind energy, support Tata Power’s renewable energy expansion.

- Technological Innovations: Adoption of advanced technologies in power generation and distribution enhances operational efficiency and cost-effectiveness. Tata Power is investing in smart grid technologies, digital transformation, and energy storage solutions to stay ahead in the industry.

Favourable Economic Conditions for Tata Power

1. Economic Growth in India: The robust economic growth in India, driven by industrialization and urbanization, leads to a significant increase in energy demand. As the economy expands, more industries and households require electricity, directly boosting Tata Power’s revenue. The ongoing infrastructure projects and the push towards a digital economy further amplify this demand, positioning Tata Power to capitalize on the growing need for reliable energy supply.

2. Inflation and Interest Rate Management: Higher inflation can increase the costs of operations, including fuel, labour, and maintenance. However, Tata Power’s effective cost management strategies can mitigate these impacts, ensuring sustained profitability. Additionally, the company’s ability to manage rising interest rates, which affect borrowing costs for capital-intensive projects, is crucial. By optimizing its debt structure and leveraging low-cost financing options, Tata Power can maintain financial stability and support its growth initiatives.

3. Stable and Rising Energy Prices: Fluctuations in energy prices significantly impact power generation companies. Stable or rising energy prices generally benefit Tata Power by maintaining or increasing profit margins. The company’s diversified energy portfolio, which includes traditional and renewable sources, allows it to navigate price volatility effectively. Strategic procurement and operational efficiency further enhance its ability to manage energy costs and protect profitability.

4. Development and Growth of Electric Vehicles (EVs): The rapid growth of the EV market presents a significant opportunity for Tata Power. The increasing adoption of EVs necessitates the development of extensive charging infrastructure. Tata Power is strategically expanding its EV charging network, creating a new revenue stream and aligning with the global shift towards sustainable transportation. Collaborations with automobile manufacturers and urban planners bolster this initiative, enhancing the company’s market presence.

5. Government Initiatives and Supportive Policies: Supportive government policies play a crucial role in Tata Power’s growth. Subsidies and incentives for EV adoption and renewable energy projects drive higher electricity consumption and investment in green energy. Government investments in infrastructure development, such as smart grids and renewable energy integration, provide additional growth opportunities. These policies help Tata Power align with national sustainability goals and enhance its operational efficiency.

6. Renewable Energy Integration: Tata Power’s commitment to renewable energy projects positions it favourably in a market increasingly focused on sustainability. Investments in solar, wind, and other renewable energy sources support the company’s growth and align with global trends towards reducing carbon footprints. Offering green energy solutions, particularly for EV charging, attracts environmentally conscious consumers and strengthens Tata Power’s brand value.

Risks Facing Tata Power Based on the Balance Sheet & current market conditions:-

1. Volatility in Sales and Profit Margins: The balance sheet shows significant fluctuations in sales and profit margins over the years. For instance:

- Sales dropped significantly in 2016 (-12.20%) and 2017 (-6.46%), then recovered in 2022 (30.92%) and 2023 (28.71%).

- Operating profit margins have also varied widely, from a low of 7.14% in 2016 to a high of 21.27% in 2021. These fluctuations indicate volatility in revenue and profitability, posing a risk to stable financial performance and predictability.

2. High Debt Levels and Interest Rate Exposure: High debt levels are a concern, especially in years with low profit margins. Rising interest rates can increase the cost of borrowing, impacting financial stability. For example:

- In 2020, the profit before tax (PBT) margin was only 6.72%, indicating financial strain. Efficient debt management and securing favorable financing terms are crucial to mitigate this risk, as high-interest costs can erode profitability.

3. Dependence on Energy Prices: The company’s profitability is highly sensitive to changes in energy prices. For instance:

- The operating profit margin was low in 2016 (7.14%) and 2018 (8.55%), likely due to higher energy costs.

- Profit before tax (PBT) showed significant volatility, with a substantial decline in 2020 (-46.99%) followed by major growth in 2022 (115.25%). Volatile energy prices can disrupt financial stability, necessitating effective hedging and cost management strategies.

4. Regulatory Risks: Changes in government policies, regulations, and tariffs can impact Tata Power’s operations and profitability. For instance:

- Any reduction in subsidies for renewable energy projects could affect Tata Power’s growth plans and revenue streams.

- Environmental regulations may increase compliance costs, impacting the bottom line. The unpredictability of regulatory changes poses a risk, requiring Tata Power to stay agile and responsive to maintain compliance and optimize operations.

5. Market Competition: The energy sector is highly competitive, with numerous players vying for market share. For example:

- Competitors may offer lower prices or more innovative solutions, impacting Tata Power’s market position. To mitigate this risk, Tata Power needs to continuously innovate and improve efficiency to maintain its competitive edge and attract customers.

6. Technological Disruptions: Rapid advancements in technology could disrupt traditional business models. For example:

- New technologies in renewable energy, energy storage, and smart grids could change the competitive landscape. Tata Power’s ability to adopt new technologies and integrate them into its operations is crucial for long-term success. Staying ahead of technological trends and investing in innovation can help the company mitigate the risk of obsolescence.

Conclusion and Investment Rationale for Tata Power

Conclusion: Tata Power is well-positioned to benefit from favourable economic conditions, technological advancements, and supportive government policies. The company’s strategic initiatives in expanding renewable energy projects, developing EV infrastructure, and enhancing operational efficiency align with global and national trends towards sustainability and energy transition. Despite the risks of market competition, regulatory changes, and technological disruptions, Tata Power’s proactive management and innovative approach provide a robust foundation for growth.

Why You Should Consider Buying Tata Power Stock:

1. Strong Economic Growth in India: India’s economy is expected to continue its robust growth trajectory, with GDP growth projected between 6.0% to 6.5% in 2024. This economic expansion drives higher energy demand, particularly from industrial and urban sectors, directly benefiting Tata Power’s revenue and growth prospects (SP Global) (India Brand Equity Foundation).

2. Leadership in Renewable Energy: Tata Power is at the forefront of India’s renewable energy revolution, with significant investments in solar, wind, and other green energy projects. India aims to achieve 500 GW of renewable energy installed capacity by 2030, and Tata Power is well-positioned to capitalize on this opportunity. The company’s ongoing projects and future plans align with government targets and the global push towards sustainable energy (PowerMin) (Invest India).

3. Expansion of EV Infrastructure: The rapid adoption of electric vehicles (EVs) in India presents a significant growth opportunity. Tata Power is expanding its EV charging infrastructure across the country, positioning itself as a key player in the emerging EV ecosystem. This expansion not only provides a new revenue stream but also supports India’s green mobility goals (India Brand Equity Foundation) (Invest India).

4. Supportive Government Policies: India’s government is heavily investing in and promoting the energy transition through various initiatives, including the National Green Hydrogen Mission, Production-Linked Incentive (PLI) schemes for solar PV manufacturing, and extensive support for renewable energy projects. These policies provide a favorable environment for Tata Power to expand its operations and improve profitability (India Brand Equity Foundation) (Invest India).

5. Technological Advancements and Innovation: Tata Power’s commitment to adopting new technologies, such as smart grids and energy storage solutions, enhances its operational efficiency and resilience. The company’s focus on innovation helps mitigate risks associated with technological disruptions and keeps it competitive in a rapidly evolving market (SP Global) (Invest India).

6. Diversified Energy Portfolio: With a mix of traditional and renewable energy sources, Tata Power has a balanced and diversified portfolio that reduces dependency on any single energy source. This diversification helps the company manage risks related to energy price volatility and regulatory changes (PowerMin).

7. Strong Stock Performance and Returns: Tata Power has delivered excellent returns over the past three years. The stock has shown a steady upward trend, with cumulative returns increasing significantly. The annualized return over the past three years is approximately 43.7%. This strong performance reflects the company’s robust financial health and growth potential, making it an attractive investment (India Brand Equity Foundation).

Cumulative Returns Analysis: The stock’s cumulative returns over the past three years have demonstrated consistent growth, as illustrated in the accompanying chart. This performance highlights Tata Power’s ability to generate substantial returns for its shareholders, driven by its strategic initiatives and favorable market conditions.

By addressing these factors, Tata Power demonstrates solid potential for growth and a resilient business model. Investing in Tata Power offers exposure to India’s dynamic energy sector and its transition towards sustainable energy solutions, making it a compelling choice for long-term investors.

References and Sources

- S&P Global: “Top trends in 2024 for India’s power and renewables markets” link (SP Global).

- IBEF: “Power Sector in India: Market Size, Industry Analysis, Govt Initiatives” link (India Brand Equity Foundation).

- Ministry of Power, Government of India: “Power Sector at a Glance ALL INDIA” link (PowerMin).

- Invest India: “Renewable Energy in India: Investment Opportunities” link (Invest India).

Frequently Asked Questions (FAQs) about Investing in Tata Power

Why should I consider investing in Tata Power?

Tata Power is a leading player in India’s energy sector, with significant investments in renewable energy, electric vehicle infrastructure, and innovative technologies. The company is well-positioned to benefit from India’s robust economic growth, supportive government policies, and the global push towards sustainable energy. Additionally, Tata Power has demonstrated strong financial performance and delivered excellent returns over the past three years.

How has Tata Power performed financially in recent years?

Tata Power has shown consistent financial growth, with significant increases in sales and profit margins. The company has delivered an annualized return of approximately 43.7% over the past three years, reflecting its robust financial health and growth potential. This performance is driven by strategic investments in renewable energy and operational efficiency.

What are the key risks associated with investing in Tata Power?

The key risks include volatility in energy prices, regulatory changes, high debt levels, market competition, and technological disruptions. However, Tata Power’s diversified energy portfolio, proactive management, and innovative approach help mitigate these risks and support sustained growth.

How is Tata Power contributing to the renewable energy sector?

Tata Power is a leader in India’s renewable energy sector, with significant investments in solar, wind, and other green energy projects. The company aligns with India’s goal of achieving 500 GW of renewable energy installed capacity by 2030 and is actively involved in various initiatives to promote sustainable energy.

What are Tata Power’s plans for electric vehicle infrastructure?

Tata Power is expanding its electric vehicle (EV) charging infrastructure across India, positioning itself as a key player in the emerging EV ecosystem. This expansion supports India’s green mobility goals and provides a new revenue stream for the company, contributing to its long-term growth strategy.

How do government policies support Tata Power’s growth?

India’s government has implemented various supportive policies, including the National Green Hydrogen Mission, Production-Linked Incentive (PLI) schemes for solar PV manufacturing, and extensive support for renewable energy projects. These policies create a favorable environment for Tata Power to expand its operations and improve profitability.

What is Tata Power’s approach to technological advancements and innovation?

Tata Power is committed to adopting new technologies, such as smart grids and energy storage solutions, to enhance its operational efficiency and resilience. The company’s focus on innovation helps mitigate risks associated with technological disruptions and keeps it competitive in a rapidly evolving market.

How diversified is Tata Power’s energy portfolio?

Tata Power has a balanced and diversified energy portfolio, including traditional fossil fuels and renewable energy sources. This diversification reduces dependency on any single energy source and helps the company manage risks related to energy price volatility and regulatory changes.

What are the future growth prospects for Tata Power?

Tata Power’s future growth prospects are strong, driven by its leadership in renewable energy, expansion of EV infrastructure, supportive government policies, and continuous innovation. The company is well-positioned to benefit from India’s economic growth and the global transition towards sustainable energy solutions.

Where can I find more information about Tata Power’s financial performance and strategic initiatives?

Detailed information about Tata Power’s financial performance, strategic initiatives, and growth prospects can be found on their official website and through reputable financial news sources such as S&P Global, IBEF, the Ministry of Power (Government of India), and Invest India.