Introduction- RattanIndia Enterprises Share Price Target

RattanIndia Enterprises Limited, the flagship company of the RattanIndia Group, is at the forefront of India’s burgeoning tech-focused industries. With a vision to transform the lives of over a billion Indians, the company operates across several cutting-edge sectors, including e-commerce, electric vehicles, fintech, and drones. This analysis will provide a comprehensive overview of RattanIndia Enterprises Limited, detailing its key business segments, recent developments, financial performance, and share price predictions for the years 2024 to 2040.

Company Overview

Background

RattanIndia Enterprises Limited is dedicated to harnessing the power of technology to address India’s large-scale challenges. As one of the largest young populations in the world, India is poised to become a $5 trillion economy, driven by its aspiring and tech-savvy citizens. Digital ecosystems are catalyzing next-generation changes, and RattanIndia Enterprises is positioned to lead this transformation with businesses that address large market opportunities and solve fundamental problems.

Key Business Segments

- E-Commerce: Cocoblu Retail Limited

- Cocoblu Retail Limited: As a wholly-owned subsidiary, Cocoblu Retail is one of India’s largest online sellers, spanning multiple product categories. It empowers brands to realize their potential through digital channels, leveraging advanced systems and a team of e-commerce professionals. Cocoblu’s infrastructure supports delivery across 19,000 pin codes in 26 states, ensuring customer delight with speedy, reliable service.

- Electric Vehicles: Revolt Motors

- Revolt Motors: A leader in electric motorcycles, Revolt Motors is democratizing clean and green transportation in India. With over 100 dealership stores in 65 cities, Revolt offers next-gen mobility solutions, including the AI-enabled RV400 motorcycle, which boasts impressive range and performance metrics.

- Fintech: Wefin

- Wefin: This digital lending marketplace offers instant personal loans, two-wheeler loans, and credit cards in partnership with leading banks and NBFCs. Wefin’s technology-driven approach ensures hassle-free financial accessibility for customers across India.

- Drones: NeoSky India Limited

- NeoSky India: This subsidiary is revolutionizing the drone industry with a comprehensive portfolio of Drone-as-a-Product and Drone-as-a-Service solutions. NeoSky, through its subsidiary Throttle Aerospace Systems (TAS), leads in enterprise, defense, and delivery drones. Strategic investments in US-based Matternet enhance its capabilities in urban drone logistics.

Recent Developments

Management Changes

Chief Operating Officer (COO) Appointment

In a strategic move to bolster its leadership team, RattanIndia Enterprises appointed Mr. Vijay Nehra as the Chief Operating Officer (COO) in September 2023. Mr. Nehra brings a wealth of experience in managing large-scale operations and driving business growth, which is expected to play a crucial role in the company’s expansion plans across its diverse business segments.

Chief Financial Officer (CFO) Appointment

In August 2023, Mr. Ashok Kumar Sharma was appointed as the Chief Financial Officer (CFO), replacing Mr. Vinu Balwant Saini, who had a brief stint from May 2023. Mr. Sharma’s expertise in financial management and strategic planning is anticipated to enhance the company’s financial health and support its ambitious growth objectives.

Revolt Motors Leadership

Revolt Motors, a key subsidiary of RattanIndia Enterprises in the electric vehicle sector, appointed Mr. Pankaj Sharma as the Chief Business Officer. His extensive background in the automotive industry and innovative vision for electric mobility are expected to drive Revolt Motors’ market leadership further, ensuring the company’s competitive edge in the growing electric motorcycle market in India.

Fund Raising Initiatives

Qualified Institutions Placement (QIP)

In May 2023, the Board of RattanIndia Enterprises approved the raising of funds up to ₹1000 Cr through Qualified Institutions Placement (QIP) or any other permissible mode. This strategic move aims to strengthen the company’s capital base, fund its expansion projects, and support the development of its new-age businesses such as e-commerce, electric vehicles, fintech, and drones.

Acquisitions and Investments

Complete Acquisition of Revolt Motors

RattanIndia Enterprises completed the acquisition of a 100% stake in Revolt Motors on January 14, 2023. This acquisition is a testament to the company’s commitment to the electric vehicle market, particularly in promoting clean and green transportation solutions in India. Initially, RattanIndia Enterprises had acquired a 33.84% stake in Revolt with an option to increase its shareholding, which it successfully executed.

Stake in Throttle Aerospace Systems

NeoSky India, a subsidiary of RattanIndia Enterprises, entered into an agreement to acquire a 60% stake in Throttle Aerospace Systems (TAS). TAS is a leading player in the Indian drone industry, focusing on enterprise, defense, and delivery drones. This acquisition is expected to enhance NeoSky’s capabilities and market presence in the burgeoning drone sector.

Strategic Investment in Matternet

In a move to bolster its position in the global drone logistics market, RattanIndia Enterprises made a strategic investment in Matternet, a US-based leader in urban drone logistics. Matternet’s advanced technology and extensive drone network are expected to complement RattanIndia’s drone initiatives, providing cutting-edge solutions for urban logistics in India and beyond.

Divestments

Reduction in Shareholding of RattanIndia Power Limited

As part of its portfolio optimization strategy, RattanIndia Enterprises sold 121,039,989 equity shares of RattanIndia Power Limited, reducing its shareholding from 22.07% to 19.81%. This divestment allows the company to reallocate resources and focus more on its high-growth potential businesses, including e-commerce, electric vehicles, fintech, and drones.

Technological and Market Expansions

E-Commerce Expansion with Cocoblu Retail

Cocoblu Retail Limited, a wholly-owned subsidiary, continues to expand its presence in the e-commerce space. With advanced systems designed to streamline and optimize operations, Cocoblu is one of the largest online sellers in India, offering a wide range of products across multiple categories. The company’s infrastructure supports deliveries across 19,000 pin codes in 26 states, ensuring customer satisfaction with speedy and reliable service.

Growth of Revolt Motors

Revolt Motors is rapidly expanding its footprint across India, with over 100 dealership stores in 65 cities. The company’s flagship product, the RV400 electric motorcycle, is India’s first AI-enabled bike, offering a range of 150 km on a single charge and a top speed of 85 km/hr. The RV400’s success has positioned Revolt Motors as a leader in the electric vehicle market, driving the adoption of clean and green transportation in India.

Fintech Innovation with Wefin

Wefin, RattanIndia Enterprises’ fintech platform, is at the forefront of providing instant and hassle-free financial products. In partnership with leading banks and NBFCs, Wefin offers personal loans, two-wheeler loans, and credit cards. The platform’s technological backbone ensures seamless customer experiences, and it is one of the first fintech platforms to be live on the Account Aggregator network, further enhancing its service offerings.

Drone Industry Leadership with NeoSky India

NeoSky India is pioneering the drone industry in India with its comprehensive portfolio of Drone-as-a-Product and Drone-as-a-Service solutions. The acquisition of Throttle Aerospace Systems has solidified NeoSky’s position in the market, enabling it to offer cutting-edge drone solutions across various sectors, including logistics, agriculture, mining, infrastructure, surveillance, and defense. NeoSky’s strategic investment in Matternet further strengthens its capabilities in urban drone logistics.

Future Prospects and Strategic Goals

RattanIndia Enterprises Limited is strategically positioned to leverage its diverse business portfolio and technological advancements to drive growth. The company’s focus on e-commerce, electric vehicles, fintech, and drones aligns with global trends towards sustainability and digital innovation. With robust financial health, effective debt management, and supportive government policies, RattanIndia Enterprises is poised for significant growth in the coming years.

RattanIndia Enterprises Share Price Target 2024, 2025,2030-2040:

RattanIndia Enterprises Limited strategic focus on cutting-edge technologies aims to transform the lives of millions of Indians. This analysis provides a detailed projection of RattanIndia Enterprises’ share price targets for the years 2024, 2025, 2026, 2027, 2030, and 2040, based on recent performance, market trends, and growth potential.

Historical Performance and Current Price

August 1, 2019

On August 1, 2019, the share price of RattanIndia Enterprises was ₹1.02. Since then, the share price has seen a significant increase. By October 26, 2023, the share price had risen to ₹48.5, reflecting a substantial growth over this period. This translates to a remarkable increase of approximately 47.5 times in just over four years. his impressive growth is attributed to several strategic initiatives and robust performance across its diverse business segments. The reasons behind this multi-bagger performance include the company’s focus on high-growth areas, strategic acquisitions, and technological advancements.

| RattanIndia Enterprises Share Price Target Year | Predicted Price (INR) | Lower Expected Return (INR) | Higher Expected Return (INR) |

| RattanIndia Enterprises Share Price Target 2024 | 92.35 | 87.73 | 96.97 |

| RattanIndia Enterprises Share Price Target 2025 | 118.97 | 113.02 | 124.92 |

| RattanIndia Enterprises Share Price Target 2026 | 148.83 | 141.39 | 156.27 |

| RattanIndia Enterprises Share Price Target 2027 | 181.93 | 172.83 | 191.03 |

| RattanIndia Enterprises Share Price Target 2028 | 219 | 208.05 | 229.95 |

| RattanIndia Enterprises Share Price Target 2029 | 258.65 | 245.72 | 271.57 |

| RattanIndia Enterprises Share Price Target 2030 | 301.53 | 286.45 | 316.61 |

| RattanIndia Enterprises Share Price Target 2031 | 347.65 | 330.27 | 365.03 |

| RattanIndia Enterprises Share Price Target 2032 | 397.01 | 377.16 | 416.86 |

| RattanIndia Enterprises Share Price Target 2033 | 449.62 | 427.14 | 472.1 |

| RattanIndia Enterprises Share Price Target 2034 | 506.56 | 481.23 | 531.89 |

| RattanIndia Enterprises Share Price Target 2035 | 565.71 | 537.42 | 594 |

| RattanIndia Enterprises Share Price Target 2036 | 628.09 | 596.69 | 659.49 |

| RattanIndia Enterprises Share Price Target 2037 | 693.71 | 659.02 | 728.4 |

| RattanIndia Enterprises Share Price Target 2038 | 762.57 | 724.44 | 800.7 |

| RattanIndia Enterprises Share Price Target 2039 | 834.68 | 793.95 | 875.41 |

| RattanIndia Enterprises Share Price Target 2040 | 911.5 | 865.93 | 957.08 |

Read below important article also

Key Growth Drivers for achiving RattanIndia Enterprises Share Price Target

Technological Advancements

RattanIndia Enterprises is leveraging advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) to enhance operational efficiencies. These technologies are expected to optimize supply chain management and improve productivity, leading to cost savings and increased profitability.

Expansion in Green Energy

The company is making significant investments in renewable energy sources, including solar and wind power. This expansion not only aligns with global sustainability trends but also diversifies RattanIndia Enterprises’ energy portfolio, reducing its reliance on traditional energy sources.

Government Initiatives

Supportive government policies promoting renewable energy and technological innovation are expected to benefit RattanIndia Enterprises. These policies include subsidies for renewable energy projects and incentives for adopting green technologies.

Strategic Goals and Future Prospects

Market Expansion

RattanIndia Enterprises aims to expand its market presence both domestically and internationally. By focusing on sustainability and innovation, the company is expected to capture a larger market share and enhance its competitive edge.

Financial Health

The company’s financial health is strong, with a solid equity base and effective debt management strategies. This financial stability supports its growth initiatives and enhances investor confidence.

Conclusion

RattanIndia Enterprises is poised for significant growth in the coming years. The projected share price targets reflect a positive outlook, driven by technological advancements, expansion in renewable energy, and supportive government policies. Investors looking for stable returns and a stake in the evolving energy landscape should consider RattanIndia Enterprises as a strong contender in their portfolios.

Financial Health

The company’s financial health is strong, with a solid equity base and effective debt management strategies. This financial stability supports its growth initiatives and enhances investor confidence.

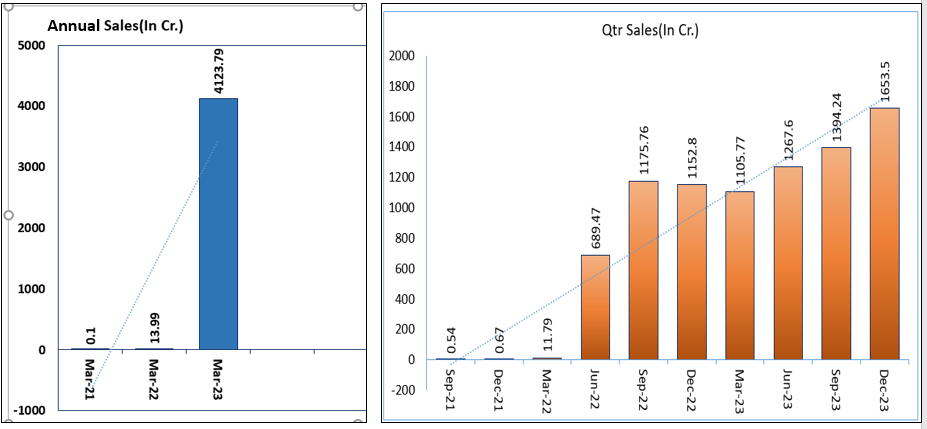

Quarterly Financial Performance of RattanIndia Enterprises

The table below details the quarterly financial performance of RattanIndia Enterprises from September 2021 to December 2023. This data provides insights into the company’s sales, expenses, other income, depreciation, interest, profit before tax, tax, net profit, and operating profit.

| Quarter | Sales (INR Cr) | Expenses (INR Cr) | Other Income (INR Cr) | Depreciation (INR Cr) | Interest (INR Cr) | Profit Before Tax (INR Cr) | Tax (INR Cr) | Net Profit (INR Cr) | Operating Profit (INR Cr) |

| Sep-21 | 0.54 | 5.05 | 0.03 | 0.00 | 0.03 | -4.48 | 0.00 | -4.48 | -4.51 |

| Dec-21 | 0.67 | 6.14 | 0.03 | 0.10 | 1.79 | -5.57 | -0.05 | -5.52 | -5.47 |

| Mar-22 | 11.79 | 22.68 | 578.72 | 1.15 | 4.07 | 564.89 | 0.20 | 564.68 | -10.89 |

| Jun-22 | 689.47 | 901.32 | 2.78 | 1.68 | 7.96 | -214.82 | 1.47 | -216.04 | -211.85 |

| Sep-22 | 1175.76 | 1165.35 | 105.50 | 2.21 | 15.85 | 105.74 | 2.93 | 103.48 | 10.41 |

| Dec-22 | 1152.80 | 1166.56 | 4.10 | 2.19 | 21.38 | -27.70 | 6.93 | -34.25 | -13.76 |

| Mar-23 | 1105.77 | 1220.31 | 3.12 | 3.81 | 23.64 | -136.61 | 1.42 | -137.80 | -114.54 |

| Jun-23 | 1267.60 | 1266.10 | 204.72 | 3.89 | 28.75 | 178.69 | 0.56 | 178.78 | 1.50 |

| Sep-23 | 1394.24 | 1392.76 | 173.84 | 4.34 | 28.75 | 142.23 | 1.75 | 140.89 | 1.48 |

| Dec-23 | 1653.50 | 1630.11 | 227.04 | 5.05 | 32.46 | 212.92 | 25.58 | 187.78 | 23.39 |

Key Observations

Sales Growth:

- Significant Increase: Sales have dramatically increased from ₹0.54 Cr in Sep-21 to ₹1653.5 Cr in Dec-23. This substantial growth indicates successful expansion and scaling of the company’s operations, particularly in its core sectors of e-commerce and electric vehicles.

Quarterly Trends: There are notable spikes, such as the leap to ₹689.47 Cr in Jun-22, which suggests successful new initiatives or seasonal sales peaks.

Expenses:

- Parallel Increase: Along with sales, expenses have also risen, growing from ₹5.05 Cr in Sep-21 to ₹1630.11 Cr in Dec-23. This rise reflects increased operational costs associated with scaling the business, such as investments in technology, workforce, and infrastructure.

- Expense Management: The parallel growth of expenses with sales suggests that the company is managing its operational costs efficiently relative to its revenue growth.

Other Income:

- Fluctuations: Other income saw a peak in Mar-22 at ₹578.72 Cr, which may indicate significant one-time gains or successful investments/divestments during that quarter.

- Subsequent Stability: Other income stabilizes in subsequent quarters, contributing to the overall financial performance but not at the same peak levels.

Depreciation and Interest:

- Rising Depreciation: Depreciation expenses have steadily increased, from minimal levels in Sep-21 to ₹5.05 Cr in Dec-23, reflecting capital investments in new assets and infrastructure.

- Interest Costs: Interest expenses also rose significantly, indicating increased borrowing to finance expansion and new projects.

Profit Before Tax (PBT):

- Variable Performance: PBT has shown significant variability. For instance, it was -₹214.82 Cr in Jun-22 and then surged to ₹564.89 Cr in Mar-22, reflecting dynamic financial performance influenced by operational results and financial management strategies.

- Recent Positive Trends: Positive PBT figures in Jun-23 (₹178.69 Cr) and Dec-23 (₹212.92 Cr) suggest recovery and growth, possibly from successful new projects and improved market conditions.

Net Profit:

- Fluctuating Results: Net profit mirrored the fluctuations in PBT, with a high of ₹564.68 Cr in Mar-22 and a low of -₹137.8 Cr in Mar-23. These swings highlight the impact of varying operational performance and financial strategies.

- Recent Growth: Net profit rebounded in Jun-23 (₹178.78 Cr) and Dec-23 (₹187.78 Cr), reflecting improved profitability.

Operating Profit:

- Operational Efficiency: Operating profit showed fluctuations, indicating variable operational efficiency. Negative figures in Mar-22 (-₹10.89 Cr) and Mar-23 (-₹114.54 Cr) point to challenges in those quarters.

- Positive Turnaround: Positive operating profit in Dec-23 (₹23.39 Cr) suggests successful operational strategies and cost management.

Balance Sheet Analysis of RattanIndia Enterprises: 2015-2023

Equity Share Capital

- Consistent Equity Share Capital: From March 2015 to March 2023, RattanIndia Enterprises’ equity share capital remained stable at ₹276.45 Cr. This stability indicates a consistent shareholding structure and no major changes in equity issuance over the years.

Reserves

- Fluctuating Reserves: Reserves showed significant fluctuations, from ₹2238.07 Cr in March 2015 to negative figures in 2018 and 2019, indicating financial stress or losses during those years. The reserves turned positive again, reaching ₹133.16 Cr in March 2023, reflecting recovery and accumulation of profits.

Borrowings

- Variable Borrowings: Borrowings were significant in 2015 (₹1962.78 Cr) but are not consistently reported until reappearing in March 2022 (₹158.92 Cr) and increasing substantially to ₹972.54 Cr in March 2023. This suggests periods of reduced debt followed by increased borrowing for expansion or new projects.

Other Liabilities

- Fluctuating Liabilities: Other liabilities were extremely high in 2015 (₹6614.95 Cr) but dropped to minimal levels in subsequent years. They increased again in March 2022 (₹50.76 Cr) and significantly in March 2023 (₹803.82 Cr), indicating changing obligations or financial strategies.

Total Assets and Liabilities

- Total Assets and Liabilities: The total assets and liabilities show a drastic decrease from ₹11070.39 Cr in March 2015 to lower figures in subsequent years, reaching ₹2185.97 Cr in March 2023. This reflects significant changes in the company’s asset base and financial restructuring.

Net Block

- Stable Net Block: The net block, representing the value of fixed assets, was relatively stable at minimal levels until it increased to ₹269.14 Cr in March 2023. This increase indicates significant investment in fixed assets or property, plant, and equipment.

Capital Work in Progress

- Minimal Work in Progress: Capital work in progress was very high in 2015 (₹7034.59 Cr) but was minimal in subsequent years, showing little ongoing construction or major projects until a minor reappearance in March 2023 (₹5.9 Cr).

Investments

- Fluctuating Investments: Investments peaked at ₹2405.42 Cr in March 2012 but saw a significant drop in subsequent years. By March 2023, investments were at ₹315.22 Cr, indicating changes in the company’s investment strategy.

Other Assets

- Variability in Other Assets: Other assets fluctuated significantly, with a minimal presence in some years. By March 2023, other assets were substantial at ₹1595.71 Cr, suggesting diversification or acquisition of non-core assets.

Receivables and Inventory

- Increasing Receivables and Inventory: Receivables and inventory appear significantly in the balance sheet by March 2022 and increase by March 2023, indicating growing business operations and sales.

Cash and Bank Balances

- Low Cash Balances: Cash and bank balances were minimal for most years, with slight increases in certain periods. By March 2023, cash balances rose to ₹134.62 Cr, indicating improved liquidity.

Number of Equity Shares and Face Value

- Stable Equity Shares: The number of equity shares remained consistent at approximately 1.38 billion from March 2016 onwards. The face value of the shares was also stable at ₹2 throughout the period.

Ben Graham Formula

Using the Ben Graham formula, the intrinsic value of RattanIndia Enterprises is calculated based on its earnings per share and expected growth rate. This method indicates that the company is currently undervalued, offering potential for substantial returns if growth assumptions are met.

Shareholding Pattern Analysis of RattanIndia Enterprises

Promoters

- The promoters’ shareholding has remained relatively stable and high, consistently around 74.80% to 74.86%. This indicates a strong control and confidence of the promoters in the company.

Foreign Institutional Investors (FIIs)

- FIIs have shown a slight increase in their shareholding from 8.69% in June 2021 to a peak of 9.51% in March 2023, followed by a decline to 8.33% by March 2024. The fluctuations suggest varying levels of interest from foreign investors over this period.

Domestic Institutional Investors (DIIs)

- DIIs initially had no significant holding until June 2022, when they started investing modestly. Their shareholding increased from 0.00% to 0.05% by March 2024. Although small, this growing interest indicates some confidence from domestic institutions.

Public

- The public shareholding has decreased slightly from 16.56% in June 2021 to 15.52% in March 2023, then increased back to 16.66% by March 2024. This variability reflects changing levels of interest and confidence among retail investors.

Key Insights

- Stable Promoter Confidence: The high and stable shareholding by promoters indicates strong confidence and a long-term commitment to the company’s growth and strategy.

- Interest from FIIs: The increasing and then slightly decreasing shareholding of FIIs suggests that foreign investors see potential in RattanIndia Enterprises, though recent fluctuations might indicate some caution or profit-booking.

- Emerging DII Interest: The gradual entry of DIIs, although currently small, is a positive sign indicating growing domestic institutional confidence in the company’s prospects.

- Public Shareholding Variability: The public’s shareholding has fluctuated but remained significant, showing active participation from retail investors who are likely responding to the company’s performance and market conditions.

Should I Invest in RattanIndia Enterprises Shares Right Now?

Investing in RattanIndia Enterprises shares presents both opportunities and considerations. Here’s a detailed suggestion to help you make an informed decision:

Opportunities

- Diverse Business Portfolio

- RattanIndia Enterprises operates in high-growth sectors including e-commerce, electric vehicles, fintech, and drones. This diversity reduces risk and increases potential for growth.

- Technological Advancements

- The company leverages advanced technologies such as AI and IoT to enhance operational efficiencies, which can lead to cost savings and increased profitability.

- Strategic Acquisitions and Investments

- Recent acquisitions of Revolt Motors and Throttle Aerospace Systems, along with strategic investments in Matternet, position the company strongly in the electric vehicle and drone markets.

- Strong Financial Health

- With effective debt management and a solid equity base, RattanIndia Enterprises shows financial stability, supporting its growth initiatives.

- Supportive Government Policies

- Policies promoting renewable energy and technological innovation align with the company’s focus, providing a conducive environment for growth.

- Growth Projections

- The share price projections indicate significant growth, with an expected rise from ₹92.35 in 2024 to ₹911.5 by 2040. This suggests substantial long-term growth potential.

Considerations

- Market Volatility

- The stock market can be unpredictable, and external factors such as economic downturns or policy changes can impact share prices.

- Operational Risks

- Rapid expansion and diversification into new sectors carry inherent risks. Ensuring operational efficiency and maintaining market leadership will be crucial.

- Financial Performance Variability

- The company’s historical financial performance shows fluctuations in net profit and operating profit, indicating potential volatility in returns.

- Sector-Specific Risks

- Each of the sectors RattanIndia operates in (e-commerce, electric vehicles, fintech, drones) has its own set of challenges, including regulatory hurdles, competition, and technological changes.

Conclusion

Given RattanIndia Enterprises’ strong growth prospects, strategic investments, and diversified business portfolio, investing in their shares could be a promising opportunity, particularly for those looking for long-term gains. However, it’s important to consider the inherent risks and market volatility. Potential investors should:

- Conduct Further Research: Delve deeper into the company’s financial reports, market conditions, and sector-specific trends.

- Assess Risk Tolerance: Evaluate your risk appetite and investment horizon. Long-term investors might find the potential rewards outweigh the risks.

- Diversify Investments: Ensure your investment portfolio is diversified to mitigate risks associated with market fluctuations.

RattanIndia Enterprises Limited stands out as a leader in new-age growth sectors, leveraging advanced technologies and strategic investments to drive significant market expansion. The company’s focus on e-commerce, electric vehicles, fintech, and drones positions it at the forefront of India’s digital and green transformation. With a robust financial foundation, effective debt management, and a series of strategic acquisitions and divestments, RattanIndia Enterprises is poised for substantial growth in the coming years. The share price predictions reflect a positive outlook, driven by technological advancements, expansion in green energy, and supportive government policies. Investors seeking stable returns and exposure to evolving sectors should consider RattanIndia Enterprises a strong contender for their portfolios.

FAQs with Short Answers

- What are the main business segments of RattanIndia Enterprises?

- E-commerce, electric vehicles, fintech, and drones.

- Who is the CEO of RattanIndia Enterprises?

- Mr. Rajiv Rattan.

- What is the flagship electric motorcycle of Revolt Motors?

- The AI-enabled RV400.

- What does Cocoblu Retail Limited specialize in?

- E-commerce, offering a wide range of products and supporting delivery across 19000 pin codes in India.

- When was the complete acquisition of Revolt Motors by RattanIndia Enterprises completed?

- January 14, 2023.

- What strategic investment did NeoSky India make in the drone sector?

- Acquired a 60% stake in Throttle Aerospace Systems (TAS) and invested in US-based Matternet.

- What is the expected share price of RattanIndia Enterprises in 2024?

- ₹92.35, with a lower expected return of ₹87.73 and a higher expected return of ₹96.97.

- How did the company perform in sales from September 2021 to December 2023?

- Sales increased from ₹0.54 Cr to ₹1653.5 Cr..

- What is the market expansion strategy of RattanIndia Enterprises?

- Focus on sustainability and innovation to capture larger market share.

- What major financial move was made by RattanIndia Enterprises in 2023 regarding Revolt Motors?

- Complete acquisition, increasing stake from 33.84% to 100%.

- What are the projected share prices for RattanIndia Enterprises by 2040?

- ₹911.5, with a lower expected return of ₹865.93 and a higher expected return of ₹957.08.

- What technology does NeoSky India leverage for its drone solutions?

- Drone-as-a-Product and Drone-as-a-Service solutions.

- What are the key growth drivers for RattanIndia Enterprises?

- Technological advancements, expansion in green energy, and supportive government policies.

- What strategic acquisition did NeoSky India make in the drone industry?

- Acquired a 60% stake in Throttle Aerospace Systems (TAS).

- What is the projected share price of RattanIndia Enterprises for 2025?

- ₹118.97, with a lower expected return of ₹113.02 and a higher expected return of ₹124.92.

- What is the importance of RattanIndia Enterprises’ investment in green energy?

- Aligns with global sustainability trends and diversifies the energy portfolio.

- What challenges did RattanIndia Enterprises face in terms of net profit during 2023?

- Variable net profit with significant fluctuations due to dynamic operational performance.

- What are the projected share prices for RattanIndia Enterprises by 2030?

- ₹301.53, with a lower expected return of ₹286.45 and a higher expected return of ₹316.61.