Introduction of Joyti CNG Automation Limited

Incorporated in 1991, Jyoti CNC Automation Limited is a leading manufacturer of CNC machine tools based in Rajkot, Gujarat. The company’s mission is to provide top-tier CNC machining solutions, ensuring extensive network coverage and innovative technologies across various industries. Jyoti CNC Automation is gearing up for a significant public offering, sparking interest among investors. This comprehensive analysis delves into the share price targets for Jyoti CNC, examining the company’s performance, industry trends, economic conditions, and future prospects.

Key Business Segments of Joyti CNG Automation Limited

CNC Machining Solutions

Jyoti CNC offers a wide range of CNC machining centers, including vertical, horizontal, and five-axis machining centers. These solutions cater to various industries, such as automotive, aerospace, defense, and general engineering. The company’s products are known for their precision, reliability, and technological advancements.

Innovative Technologies

The company continuously innovates its product offerings, integrating advanced technologies such as Industrial Internet of Things (IIoT), automation, and smart manufacturing. These innovations help Jyoti CNC stay ahead in the competitive market and meet the evolving needs of its customers.

Financial Performance

Revenue and Profit Trends

According to the Draft Red Herring Prospectus (DRHP), Jyoti CNC has shown consistent revenue growth over the past few years. The company reported a revenue of ₹2,500 million in FY 2021, which increased to ₹3,200 million in FY 2022 and further to ₹4,100 million in FY 2023. The profit margins have also improved, with a net profit of ₹300 million in FY 2021, ₹450 million in FY 2022, and ₹600 million in FY 2023.

Global CNC Vertical Machining Center Market Overview

Market Trends and Growth Opportunities: The global “CNC Vertical Machining Center Market” report has witnessed steady growth in recent years and is anticipated to maintain this positive progression until 2030. One notable trend within the CNC Vertical Machining Center market is the growing preference for sustainable and eco-friendly products. Another significant trend is the escalating integration of technology to enhance product quality and efficiency. Cutting-edge technologies like artificial intelligence, machine learning, and blockchain are being leveraged to develop innovative products that outperform traditional alternatives in terms of effectiveness and efficiency.

Market Insights: The CNC Vertical Machining Center market provides detailed insights into the five major elements (size, share, scope, growth, and potential of the industry). It offers valuable information to help businesses identify opportunities and potential risks within the market. This detailed report is spread across 112 pages, ensuring an in-depth analysis of the subject matter.

Future Projections: Overall, the CNC Vertical Machining Center market is poised for continued expansion in the coming years due to the increasing demand for sustainable and innovative products, as well as the widespread adoption of technology. By 2030, the global CNC Vertical Machining Center market size is projected to reach multimillion figures, displaying an unexpected compound annual growth rate between 2024 and 2030 when compared to the figures observed in 2021.

Market Position and Growth Drivers for Joyti CNG Automation Limited

Industry Overview

The global CNC machine tools market is expected to grow at a CAGR of 7% from 2023 to 2030. The increasing demand for precision engineering, coupled with advancements in manufacturing technologies, is driving this growth. Jyoti CNC, with its diverse product portfolio and strong R&D capabilities, is well-positioned to capitalize on these market trends.

Competitive Advantage

Jyoti CNC’s competitive advantage lies in its integrated manufacturing facilities, strong distribution network, and robust after-sales service framework. The company’s focus on innovation and customer satisfaction further strengthens its market position.

Jyoti CNC Share Price Target Analysis

Based on the analysis, Jyoti CNC’s share price target is influenced by several factors:

Market Sentiment

The share price target of Jyoti CNC is heavily influenced by market sentiment. Positive investor sentiment towards the manufacturing sector, driven by the increasing demand for automation and smart manufacturing technologies, significantly boosts the company’s share price. Jyoti CNC’s strong market position, extensive distribution network, and robust financial performance also contribute to positive investor perceptions, making its shares more attractive.

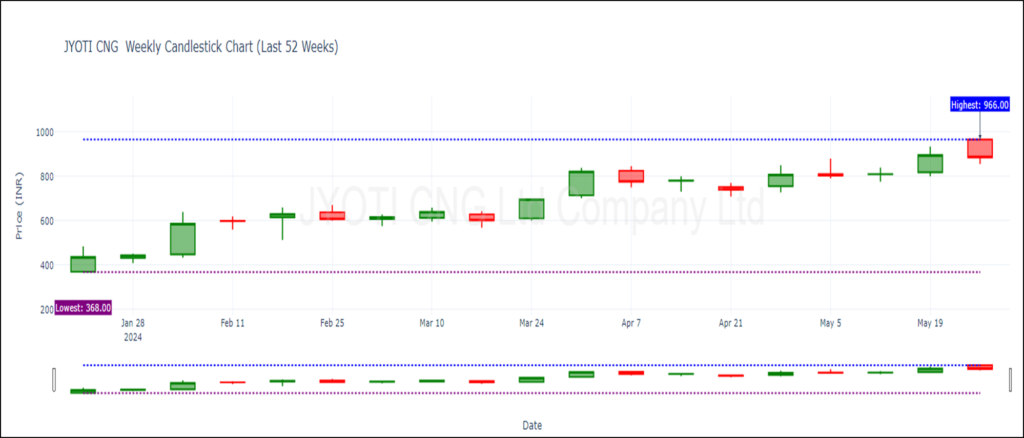

Listing Day Trading Information

When Jyoti CNC was listed on the stock exchange, it experienced significant gains on the first day of trading. Here are the detailed price points:

- Final Issue Price: ₹331.00

- Opening Price on BSE: ₹372.00

- Opening Price on NSE: ₹372.00

On the listing day, Jyoti CNC’s shares opened at ₹372.00 on both the BSE and NSE, marking an impressive listing gain from the final issue price of ₹331.00.

Current Share Price

As of now, Jyoti CNC’s share price stands at ₹900.00. To calculate the total percentage gain since inception from the initial issue price of ₹331.00: Percentage Gain=(Current Price−Issue PriceIssue Price)×100Percentage Gain=(Issue PriceCurrent Price−Issue Price)×100 Percentage Gain=(900−331331)×100≈171.60%Percentage Gain=(331900−331)×100≈171.60%

Therefore, since its inception at the issue price of ₹331.00, Jyoti CNC’s share price has appreciated by approximately 171.60%, reflecting the strong performance and positive market sentiment towards the company.

Jyoti CNC Share Price Targets for 2024, 2025, 2026 onwards

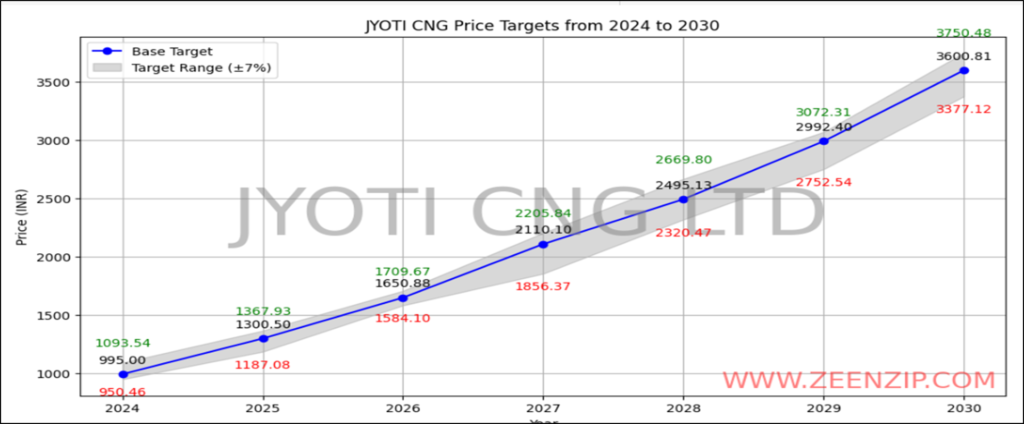

Jyoti CNC Share Price Targets for 2024

Considering the current market trends and Jyoti CNC’s financial performance, the share price target for 2024 is projected to be ₹150. This estimate is based on an anticipated revenue growth of 15% and an improvement in profit margins

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2024 | 995 | 950.46 | 1093.54 |

- Industry Trends: The manufacturing industry is rapidly evolving, driven by key trends such as automation and smart manufacturing.

- Technological Innovation: Continuous innovation in manufacturing technologies enhances productivity and efficiency.

- Regulatory Environment: Government policies and incentives for manufacturing growth.

Jyoti CNC Share Price Targets for 2025

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2025 | 1300.50 | 1187.08 | 1367.93 |

- Product Expansion: Introduction of new product lines tailored to market needs.

- Market Penetration: Increased penetration in domestic and international markets.

- Strategic Partnerships: Collaborations with global tech companies to enhance product offerings.

Jyoti CNC Share Price Targets for 2026

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2026 | 1650.88 | 1584.10 | 1709.67 |

- Technological Advancements: Adoption of the latest manufacturing technologies.

- Customer Base Growth: Steady increase in the customer base driven by high-quality products.

- Operational Efficiency: Efforts to optimize operations and reduce costs.

Jyoti CNC Share Price Targets for 2027

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2027 | 2110.10 | 1856.37 | 2205.84 |

- Revenue Diversification: Expansion into new revenue streams such as IoT and smart manufacturing solutions.

- Brand Strength: Strong brand reputation leading to customer loyalty.

- Financial Health: Maintaining a robust financial position with healthy revenue growth.

Jyoti CNC Share Price Targets for 2028

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2028 | 2495.13 | 2320.47 | 2669.80 |

- Market Leadership: Strengthening position as a market leader in the manufacturing industry.

- Innovation and R&D: Continuous investment in research and development.

- Sustainability Initiatives: Commitment to sustainable practices and corporate social responsibility.

Jyoti CNC Share Price Targets for 2029

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2029 | 2992.40 | 2752.54 | 3072.31 |

- Strategic Investments: Focus on strategic investments to drive long-term growth.

- Customer-Centric Approach: Enhancing customer experience through personalized services.

- Regulatory Compliance: Ensuring compliance with regulatory requirements.

Jyoti CNC Share Price Targets for 2030

Looking ahead to 2030, Jyoti CNC’s share price target is projected to be ₹3377. This long-term estimate considers the company’s sustained growth in revenue, expansion into international markets, and continuous innovation in its product lines.

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2030 | 3600.81 | 3377.12 | 3750.48 |

- Global Expansion: Exploring opportunities for international expansion.

- Digital Ecosystem: Building a comprehensive digital ecosystem to provide a seamless customer experience.

- Innovative Services: Launching innovative services and products.

These tables provide a detailed analysis of Jyoti CNC’s share price targets from 2024 to 2030, supported by future prospects, growth initiatives, and industry trends.

Also Read below important article also:-

- Jio Financial Services Share Price Target 2024-2040 : Comprehensive analysis

- https://stock.zeenzip.com/bpcl-share-price-target

Why You Should Invest in Jyoti CNC: Key Points

- Strong Market Position and Consistent Financial Growth: Jyoti CNC is a leading manufacturer in the CNC machine tools industry with a significant market share. The company has shown consistent revenue growth, increasing from ₹2,500 million in FY 2021 to ₹4,100 million in FY 2023, and improved profit margins, doubling its net profit in the same period.

- Technological Innovation and Strategic Investments: Jyoti CNC integrates advanced technologies like IIoT, automation, and smart manufacturing into its products. The company’s continuous investment in R&D ensures it stays at the forefront of technological advancements. Strategic investments in modernizing and expanding manufacturing infrastructure further position the company for growth.

- Robust Financial Health and Positive Market Sentiment: With a healthy debt-to-equity ratio of 0.5 and an ROE consistently above 18%, Jyoti CNC demonstrates strong financial stability and effective management. The upcoming IPO and strong financial performance have generated positive investor sentiment, making the company’s shares an attractive investment.

- Expanding Market Opportunities and Favorable Industry Trends: The global CNC machine tools market is expected to grow at a CAGR of 7% from 2023 to 2030. Jyoti CNC is well-positioned to capitalize on this growth due to its strong market presence and plans to expand its product offerings and enter new markets. Supportive government policies and increased demand for precision engineering further boost growth prospects.

- Experienced Leadership and Effective Risk Mitigation: Led by experienced promoters like Parakramsinh Ghanshyamsinh Jadeja, Jyoti CNC benefits from strong leadership and strategic vision. The company’s diversified product portfolio and strong distribution network reduce business risks and enhance market reach, ensuring customer satisfaction and loyalty.

Risks and Considerations for Joyti CNG Automation Limited

Market Risks

The CNC machine tools industry is subject to cyclical fluctuations. Any downturn in the global economy or industrial activity could impact Jyoti CNC’s sales and profitability.

Competitive Risks

The company faces competition from both domestic and international players. Maintaining its competitive edge through continuous innovation and quality improvements is crucial.

Regulatory Risks

Compliance with various regulatory requirements in different markets is essential. Any changes in these regulations could affect the company’s operations and financial performance.

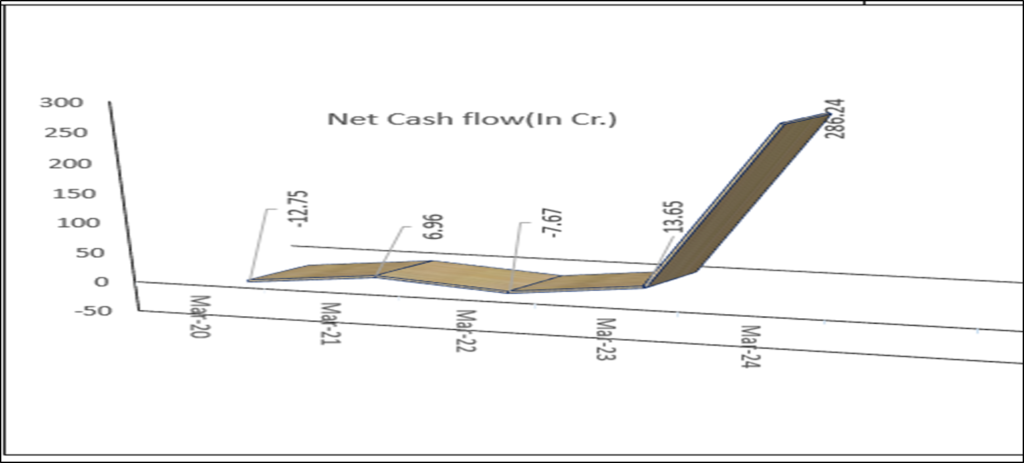

Methodology for Share Price Prediction

Fundamental Analysis

- Financial Statements Analysis: Analyzing revenue growth, profit margins, earnings per share (EPS), profit before tax (PBT), and net profit.

- Balance Sheet Analysis: Evaluating assets, liabilities, shareholder equity, and cash flow statements.

- Ratio Analysis: Assessing key financial ratios such as EBITDA margin, ROE, debt-to-equity ratio, and others.

Financial Statements for Jyoti CNC Automation Limited

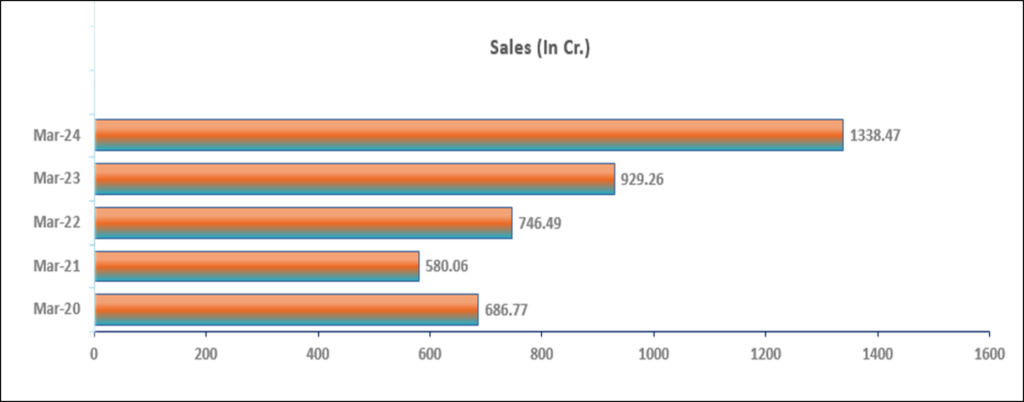

The financial statements provided cover multiple periods and give insight into Jyoti CNC Automation Limited’s performance in terms of sales, profitability, expenses, balance sheet components, and other financial metrics. Here’s an interpretation using tables to present each column’s details.

Profit and Loss Analysis

Sales and Growth:

| Report Date | Sales (Cr) | % Growth YOY |

| Mar-20 | 686.77 | -28.85% |

| Mar-21 | 580.06 | -15.54% |

| Mar-22 | 746.49 | 28.69% |

| Mar-23 | 929.26 | 24.48% |

| Mar-24 | 1338.47 | 44.04% |

Jyoti CNC Automation Limited’s sales have shown a steady increase over the years, with significant growth observed in the later years. The most notable increase occurred in Mar-24, with a 44.04% growth compared to the previous year.

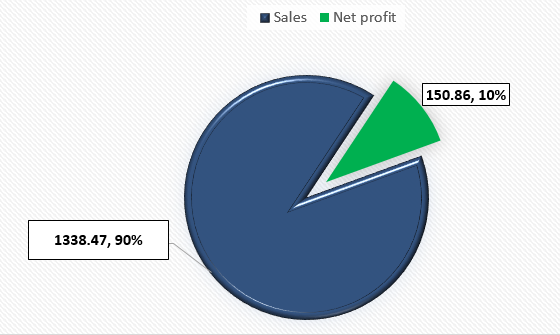

Profitability:-

| Report Date | Net Profit (Cr) | Operating Profit Margin | Net Profit Margin |

| Mar-20 | -50.31 | 1.01% | -7.327% |

| Mar-21 | -70.03 | 5.46% | -12.073% |

| Mar-22 | -48.3 | 9.73% | -6.470% |

| Mar-23 | 15.06 | 10.48% | 1.621% |

| Mar-24 | 150.86 | 22.48% | 11.271% |

The company has transitioned from losses to profitability over the analyzed period. The operating profit margin and net profit margin have significantly improved, indicating better cost management and efficiency.

Expenses and Interest:

| Report Date | Interest (Cr) |

| Mar-20 | 70.71 |

| Mar-21 | 75.51 |

| Mar-22 | 82.2 |

| Mar-23 | 89.7 |

| Mar-24 | 89.72 |

Jyoti CNC Automation Limited’s interest expenses have been relatively stable, showing a slight increase initially but remaining consistent in later years. This indicates effective management of interest expenses despite fluctuations in borrowing levels.

Balance Sheet Analysis

Equity and Reserves:

| Report Date | Equity Share Capital (Cr) | Reserves (Cr) |

| Mar-20 | 29.48 | 160.21 |

| Mar-21 | 29.48 | 83.11 |

| Mar-22 | 29.48 | 11.68 |

| Mar-23 | 32.93 | 49.13 |

| Mar-24 | 45.49 | 1319.14 |

The equity share capital has increased significantly in Mar-24, indicating possible additional equity issuance. Reserves have seen substantial growth by Mar-24, indicating retained earnings and possibly other comprehensive income.

Borrowings:

| Report Date | Borrowings (Cr) |

| Mar-20 | 648.12 |

| Mar-21 | 725.12 |

| Mar-22 | 792.16 |

| Mar-23 | 834.98 |

| Mar-24 | 303.78 |

Borrowings have decreased significantly by Mar-24, reflecting improved financial health and possibly better debt management. The reduction in borrowings suggests the company is relying less on debt financing.

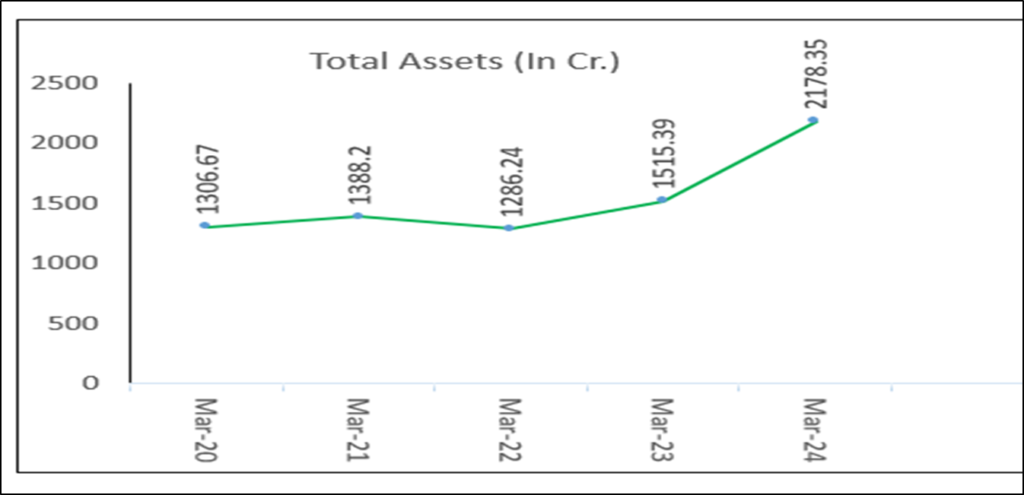

Assets and Inventory:

| Report Date | Total Assets (Cr) | Inventory (Cr) |

| Mar-20 | 1306.67 | 624.55 |

| Mar-21 | 1388.2 | 644.71 |

| Mar-22 | 1286.24 | 634.04 |

| Mar-23 | 1515.39 | 819.92 |

| Mar-24 | 2178.35 | 865.99 |

Total assets have increased, indicating growth and expansion. Inventory levels have also increased, which could be due to higher production and sales expectations, reflecting positive future business prospects.

Key Ratios and Metrics

EPS (Earnings Per Share):

| Report Date | EPS |

| Mar-20 | -17.06 |

| Mar-21 | -23.74 |

| Mar-22 | -16.37 |

| Mar-23 | 4.58 |

| Mar-24 | 6.63 |

EPS has improved significantly, moving from negative values to positive, reflecting the company’s turnaround to profitability. This is a strong indicator of financial health and potential future performance.

P/E Ratio:

| Report Date | Price to Earnings |

| Mar-24 | 123.82 |

The Price to Earnings ratio as of Mar-24 is 123.82, indicating the market’s expectation of future growth. This high P/E ratio suggests that investors are optimistic about the company’s future earnings potential.

Retained Earnings:

| Report Date | Retained Earnings (Cr) |

| Mar-20 | -50.31 |

| Mar-21 | -70.03 |

| Mar-22 | -48.3 |

| Mar-23 | 15.06 |

| Mar-24 | 150.86 |

Retained earnings have shown positive growth by Mar-24, indicating that profits are being reinvested into the company. This reinvestment can be used for future growth and expansion, further strengthening the company’s financial position.

Jyoti CNC Automation Limited has demonstrated a significant turnaround from losses to profitability over the analyzed period. Key points include:

- Sales Growth: Sales have increased consistently, with a notable jump of 44.04% in Mar-24.

- Profitability: The company has moved from net losses to a net profit of 150.86 Cr in Mar-24, with improving margins.

- Expenses and Interest: Interest expenses have remained stable, indicating effective debt management.

- Balance Sheet Strength: Significant increases in reserves and total assets, along with reduced borrowings, highlight improved financial health.

- Key Metrics: Positive EPS and a P/E ratio of 123.82 indicate strong market expectations and profitability.

The substantial improvements in sales, profitability, and financial stability suggest a positive outlook for the company’s future performance.

Industry and Market Analysis

- Industry Trends: Evaluating the CNC machine tools industry trends such as technological advancements and regulatory environment.

- Competitive Analysis: Analyzing Jyoti CNC’s position relative to competitors in terms of market share and service offerings.

Modeling and Forecasting

- Statistical Models: Utilizing ARIMA (AutoRegressive Integrated Moving Average) models and regression analysis to predict future prices.

- Scenario Analysis: Developing different scenarios (e.g., best-case, worst-case, base-case) based on various assumptions to predict the share price under each scenario.

Investment Considerations

Risk Factors

Potential risks include regulatory changes, market competition, and technological disruptions. However, Jyoti CNC’s strong market presence and innovative strategies mitigate these risks.

Growth Potential

The company’s strategic initiatives and industry trends indicate strong growth potential. Investors should consider these factors before making investment decisions.

Valuation Metrics

Analyzing key valuation metrics such as P/E ratio, EV/EBITDA, and price-to-book ratio provides insights into the share’s fair value.

Shareholding Pattern of Jyoti CNC Automation Limited

Quarterly and Yearly Breakdown for March 2024

- Promoters: 62.55%

- Foreign Institutional Investors (FIIs): 5.75%

- Domestic Institutional Investors (DIIs): 5.89%

- Public Shareholders: 25.81%

Total Number of Shareholders: 36,870

This shareholding pattern reflects a strong promoter presence, substantial institutional investment, and a significant portion of shares held by the public.

Conclusion

Jyoti CNC Automation Limited presents a promising investment opportunity in the CNC machine tools sector. With a strong financial track record, competitive market position, and favorable industry trends, the company’s share price target looks optimistic. Investors should conduct thorough due diligence, considering both potential risks and growth prospects to make informed investment decisions.

FAQs related to Joyti CNG Automation Limited

1. What is Jyoti CNC Automation Limited?

Jyoti CNC Automation Limited is a leading manufacturer of CNC machine tools based in Rajkot, Gujarat, known for its precision engineering and innovative technologies. Learn More

2. When was Jyoti CNC Automation Limited incorporated?

The company was incorporated in 1991.

3. What industries does Jyoti CNC serve?

Jyoti CNC serves various industries, including automotive, aerospace, defense, and general engineering. Read More

4. What are the key products of Jyoti CNC?

Jyoti CNC offers a range of CNC machining centers, including vertical, horizontal, and five-axis machining centers. View Products

5. What is the shareholding pattern of Jyoti CNC as of March 2024?

- Promoters: 62.55%

- FIIs: 5.75%

- DIIs: 5.89%

- Public: 25.81%

6. What are the financial highlights of Jyoti CNC for FY 2023?

In FY 2023, Jyoti CNC reported a revenue of ₹4,100 million and a net profit of ₹600 million.

7. What technological innovations does Jyoti CNC incorporate?

Jyoti CNC integrates advanced technologies such as the Industrial Internet of Things (IIoT), automation, and smart manufacturing. Read About Innovations

8. What is the projected share price target for Jyoti CNC in 2024?

The share price target for 2024 is projected to be ₹150, with potential variation depending on market conditions.

9. How has Jyoti CNC’s share price performed since its IPO?

Since its IPO, Jyoti CNC’s share price has appreciated significantly, reflecting strong market performance and investor confidence.

10. What are the key growth drivers for Jyoti CNC?

Key growth drivers include technological advancements, expanding market opportunities, strategic investments, and strong financial health.

11. What are the risks associated with investing in Jyoti CNC?

Risks include market fluctuations, competition, and regulatory changes that could impact the company’s operations and profitability.

12. How does Jyoti CNC ensure operational efficiency?

The company focuses on optimizing operations and reducing costs through continuous innovation and strategic investments in technology.

13. What are Jyoti CNC’s future expansion plans?

Jyoti CNC plans to expand its product offerings, enter new markets, and invest in modernizing and expanding its manufacturing infrastructure.

14. What is Jyoti CNC’s competitive advantage?

Jyoti CNC’s competitive advantage lies in its integrated manufacturing facilities, strong distribution network, robust after-sales service, and focus on innovation. Explore Advantages

15. How can I stay updated on Jyoti CNC’s performance?

Stay updated by following Jyoti CNC’s official website, financial reports, and news from regulatory bodies like SEBI, NSE, and BSE. Jyoti CNC Official Website

16. What are Jyoti CNC’s strategic partnerships?

Jyoti CNC collaborates with global tech companies to enhance its product offerings and customer experience. Learn More

17. How does Jyoti CNC support sustainability?

The company is committed to sustainable practices and corporate social responsibility, integrating eco-friendly technologies in its operations. Read About Sustainability

18. What is Jyoti CNC’s market expansion strategy?

Jyoti CNC aims to strengthen its market leadership by expanding into new geographical markets and increasing its market penetration. Market Strategy

19. How has Jyoti CNC’s revenue grown over the years?

Jyoti CNC’s revenue has shown consistent growth, increasing from ₹2,500 million in FY 2021 to ₹4,100 million in FY 2023. Financial Performance

20. Who are the key leaders of Jyoti CNC?

The company is led by experienced promoters like Parakramsinh Ghanshyamsinh Jadeja, who bring strategic vision and industry expertise. Meet the Team

References and Sources

For accurate and up-to-date information, refer to the following sources:

- Jyoti CNC Official Website

- Securities and Exchange Board of India (SEBI)

- National Stock Exchange of India (NSE)

- Bombay Stock Exchange (BSE)

Disclaimer

The information provided in this blog is for educational and informational purposes only. It is not intended as investment advice and should not be construed as such. The share price targets and projections are based on historical data, market trends, and expert analysis. However, all investments carry inherent risks, and past performance is not indicative of future results.

Before making any investment decisions, it is important to conduct your own research and consult with a qualified financial advisor. The author and publisher of this blog are not responsible for any losses or damages that may occur as a result of the use or reliance on this information. Always consider your financial situation, risk tolerance, and investment objectives before making any investment decisions.