Introduction:- Bharti Hexacom Share Price Target

Incorporated in 1995, Bharti Hexacom Limited provides fixed-line telephone and broadband services to customers in Rajasthan and North East telecom circles. The mission of Bharti Hexacom is to provide top-tier telecommunications services, ensuring extensive network coverage and innovative solutions across India. The company aims to leverage advanced technologies to enhance connectivity and customer experience.

Bharti Hexacom Limited is gearing up for a significant public offering, sparking interest among investors. Established as a prominent player in the Indian telecommunications sector, Bharti Hexacom is set to make its mark on the stock market. This comprehensive analysis delves into the share price targets for Bharti Hexacom, examining the company’s performance, industry trends, economic conditions, and future prospects.

Key Business Segments of Bharti Hexacom Limited

Mobile Services:

Bharti Hexacom provides a wide range of mobile services, including voice and data, catering to both urban and rural areas. The company offers affordable prepaid and postpaid plans, ensuring that customers across different income brackets have access to reliable mobile services. Their voice services ensure clear call quality, while their data services offer fast and stable internet connectivity, vital for the growing demand in mobile internet usage.

Internet Services:

The company offers high-speed internet services, ensuring reliable connectivity for individual and corporate users. Bharti Hexacom’s broadband services are designed to support high data usage, making them ideal for streaming, online gaming, and remote work. The company also provides customized internet solutions for businesses, helping them maintain seamless operations and enhance productivity.

Value-Added Services:

Bharti Hexacom continuously innovates its service offerings, including entertainment, security, and communication enhancements. The company provides a variety of value-added services (VAS) such as music and video streaming, mobile TV, and digital payments. Security services include mobile security solutions that protect against malware and cyber threats. Communication enhancements encompass services like VoLTE for high-definition voice calls and Wi-Fi calling, ensuring uninterrupted connectivity even in areas with weak mobile signals.

Operational Details

As of December 31, 2023, Bharti Hexacom operated in 486 census towns and served a total of 27.1 million customers. Within this base, there were 19.144 million data customers, of which 18.839 million were utilizing 4G and 5G services under the brand name “Airtel.”

Key Data Points – 9MFY24

- Customer Base: 26.782 million

- Average Revenue Per User (ARPU): ₹197

- Revenue per Tower per Month: ₹222,958

Data Consumption

Its customers consumed 23.1 GB of data per customer per month during the nine months ended December 31, 2023.

Assets

The company relies on a strong network infrastructure, comprising owned and leased assets. As of December 31, 2023, it operated 24,874 network towers, owning 5,092 and leasing 19,782 towers from tower companies. It also holds a diverse spectrum portfolio, enabling the provision of 5G Plus services at a low cost through popular non-standalone network architecture.

Distribution Network

The company has an extensive distribution and service network, with 51 retail outlets and 24 small-format stores reaching 90 cities as of December 31, 2023. The distribution network comprised 616 distributors and 89,454 retail touchpoints.

CAPEX

The company’s digital services, including tailored family and converged plans under Airtel Black, have boosted customer engagement, leading to continuous revenue market share growth over the past three fiscal years. As of December 31, 2023, it invested ₹206 billion in future-ready digital infrastructure.

IPO Details

Bharti Hexacom’s IPO is a significant event, marking its first public issue of equity shares. The offer consists of up to 100,000,000 equity shares with a face value of ₹5 each. This public offering follows the book-building process, which determines the share price based on market demand. The detailed prospectus highlights several crucial aspects of the IPO, including the offer price, price band, and allocation strategy.

Bharti Hexacom Share Price Target:-

Based on the analysis, Bharti Hexacom’s share price target is influenced by several factors:-

Market Sentiment: The share price target of Bharti Hexacom is heavily influenced by market sentiment. Positive investor sentiment towards the telecommunications sector, driven by the increasing demand for data services and the growth potential of the industry, significantly boosts the company’s share price. Bharti Hexacom’s strong market position, extensive distribution network, and robust financial performance also contribute to positive investor perceptions, making its shares more attractive.

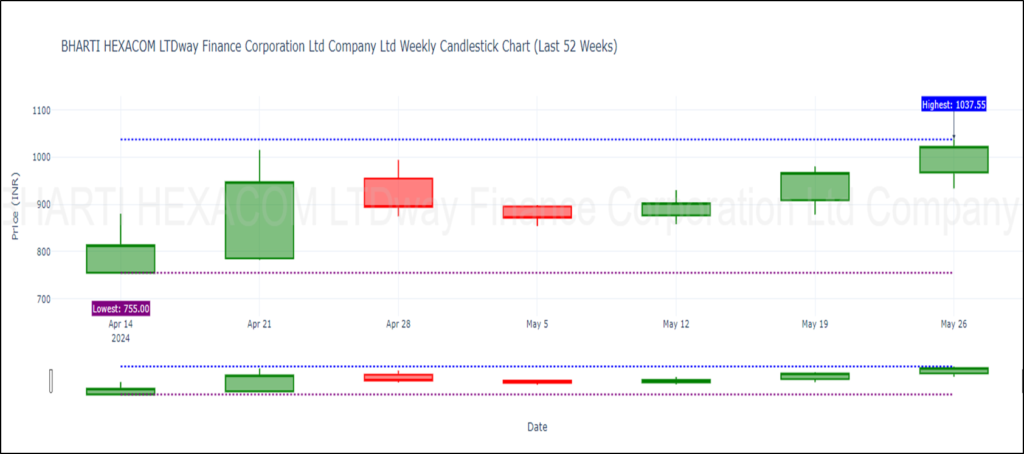

Listing Day Trading Information:

When Bharti Hexacom was listed on the stock exchange, it experienced significant gains on the first day of trading. Here are the detailed price points:

- Final Issue Price: ₹570.00

- Opening Price on BSE: ₹755.20

- Opening Price on NSE: ₹755.00

On the listing day, Bharti Hexacom’s shares opened at ₹755.20 on the BSE and ₹755.00 on the NSE, marking an impressive listing gain from the final issue price of ₹570.00.

Current Share Price:

As of now, Bharti Hexacom’s share price stands at ₹1022.00. To calculate the total percentage gain since inception from the initial issue price of ₹570.00:

Percentage Gain=(Current Price−Issue PriceIssue Price)×100Percentage Gain=(Issue PriceCurrent Price−Issue Price)×100

Percentage Gain=(1022−570570)×100≈79.30%

Therefore, since its inception at the issue price of ₹570.00, Bharti Hexacom’s share price has appreciated by approximately 79.30%, reflecting the strong performance and positive market sentiment towards the company.

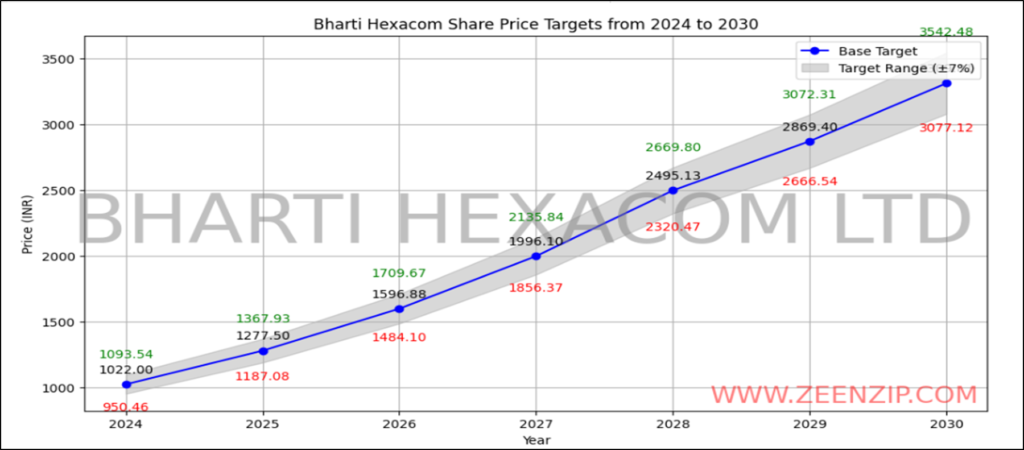

Bharti Hexacom Share Price Targets for 2024, 2025, 2026 onwards

Bharti Hexacom Share Price Targets for 2024

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2024 | 1022 | 950.46 | 1093.54 |

- Industry Trends: The telecommunications industry in India is rapidly evolving, driven by several key trends.

- 5G Deployment: The rollout of 5G networks presents significant growth opportunities, enhancing service capabilities and revenue streams.

- Digital Transformation: The shift towards digital services and applications is creating new revenue channels.

- Regulatory Environment: Government policies and regulatory frameworks shape the competitive landscape.

Bharti Hexacom Share Price Targets for 2025

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2025 | 1277.50 | 1187.08 | 1367.93 |

- Network Expansion: Bharti Hexacom’s ongoing network expansion, including rural areas, is expected to increase market penetration.

- Service Innovation: Introduction of innovative services and plans tailored to customer needs.

- Strategic Partnerships: Collaborations with global tech companies to enhance service offerings and customer experience.

Bharti Hexacom Share Price Targets for 2026

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2026 | 1596.88 | 1484.10 | 1709.67 |

- Technological Advancements: Adoption of the latest telecommunications technologies to improve service quality and efficiency.

- Customer Base Growth: Steady increase in the customer base driven by attractive service packages and improved customer service.

- Operational Efficiency: Efforts to optimize operations and reduce costs, thereby improving profitability.

Bharti Hexacom Share Price Targets for 2027

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2027 | 1996.10 | 1856.37 | 2135.84 |

- Revenue Diversification: Expansion into new revenue streams such as IoT and enterprise solutions.

- Brand Strength: Strong brand reputation leading to customer loyalty and retention.

- Financial Health: Maintaining a robust financial position with healthy revenue growth and profitability.

Bharti Hexacom Share Price Targets for 2028

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2028 | 2495.13 | 2320.47 | 2669.80 |

- Market Leadership: Strengthening position as a market leader in the telecommunications industry.

- Innovation and R&D: Continuous investment in research and development to stay ahead of technological advancements.

- Sustainability Initiatives: Commitment to sustainable practices and corporate social responsibility.

Bharti Hexacom Share Price Targets for 2029

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2029 | 2869.40 | 2666.54 | 3072.31 |

- Strategic Investments: Focus on strategic investments to drive long-term growth.

- Customer-Centric Approach: Enhancing customer experience through personalized services and offers.

- Regulatory Compliance: Ensuring compliance with regulatory requirements to avoid legal and financial risks.

Bharti Hexacom Share Price Targets for 2030

| Year | Base Target (₹) | Lower Target (₹) | Upper Target (₹) |

| 2030 | 3309.81 | 3077.12 | 3542.48 |

- Global Expansion: Exploring opportunities for international expansion and partnerships.

- Digital Ecosystem: Building a comprehensive digital ecosystem to provide a seamless customer experience.

- Innovative Services: Launching innovative services and products to meet evolving customer needs and preferences.

These tables provide a detailed analysis of Bharti Hexacom’s share price targets from 2024 to 2030, supported by future prospects, growth initiatives, and industry trends.

Also Read below important article also:-

- Jio Financial Services Share Price Target 2024-2040 : Comprehensive analysis

- https://stock.zeenzip.com/bpcl-share-price-target

Methodology for Share Price Prediction

Predicting the share price of Bharti Hexacom or any other company involves a combination of quantitative and qualitative analysis. The following methodology outlines a comprehensive approach:

Fundamental Analysis of Bharti Hexacom Limited

A. Financial Statements Analysis:

- Income Statement:

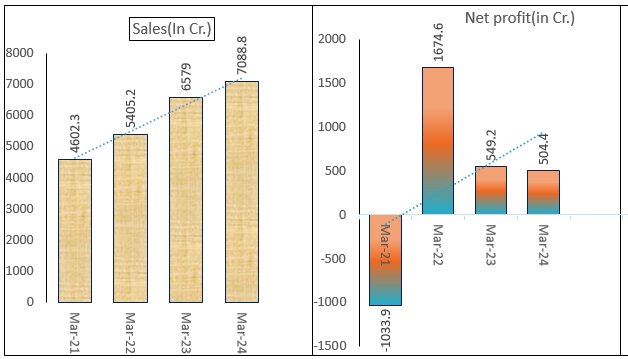

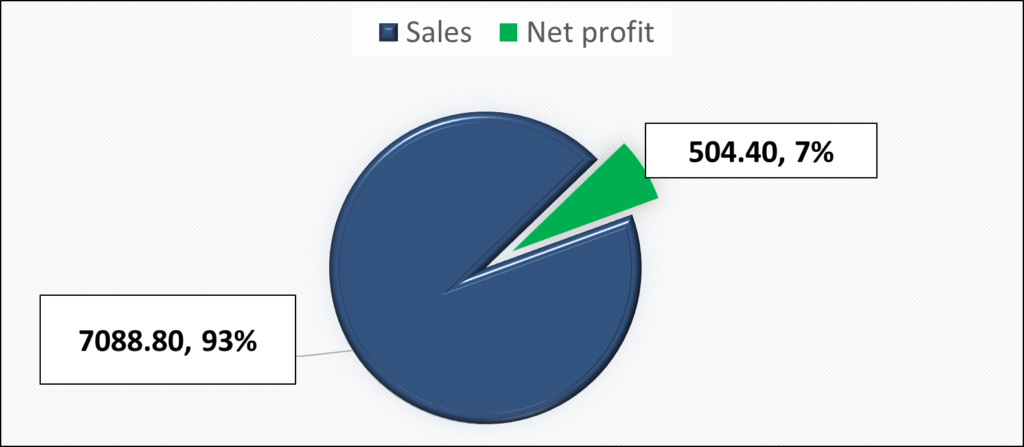

- Revenue Growth: Bharti Hexacom’s revenue has shown a consistent increase, growing from ₹3874.1 crore in Mar-20 to ₹7088.8 crore in Mar-24.

- Profit Margins: The net profit margin has fluctuated, with a high of 31.0% in Mar-22 and a lower 7.1% in Mar-24. This indicates varying profitability.

- Earnings Per Share (EPS): EPS is ₹10.1, derived from the net profit and the number of equity shares.

Profit Before Tax (PBT) and Net Profit:

- PBT has shown significant improvement from a loss of ₹3434.8 crore in Mar-20 to a profit of ₹923.3 crore in Mar-24.

- Net profit has followed a similar trend, recovering from a loss of ₹2716.5 crore in Mar-20 to a profit of ₹504.4 crore in Mar-24.

- Balance Sheet:

- Assets and Liabilities: Total assets increased from ₹15434.7 crore in Mar-20 to ₹18517.4 crore in Mar-24, indicating growth. Borrowings have decreased from ₹9203.6 crore in Mar-23 to ₹8104.6 crore in Mar-24, improving the debt situation.

- Shareholder Equity: Increased reserves from ₹2770 crore in Mar-20 to ₹4388.7 crore in Mar-24 highlight enhanced financial stability.

- Cash Flow Statement:

- Operating Cash Flows: Significant fluctuations, with a drastic increase of 306.1% in Mar-23 but a decline of -30.6% in Mar-24.

- Investing and Financing Activities: The balance sheet investments suggest strategic financial decisions.

- Total Assets: Total assets have increased steadily from ₹15434.7 crore in Mar-20 to ₹18517.4 crore in Mar-24, showing overall growth in the company’s asset base.

B. Ratio Analysis:

| Metric | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

| Sales Growth | 18.8% | 17.4% | 21.7% | 7.7% |

| PBT Growth | -71.2% | -286.1% | -60.1% | 25.8% |

| Net Profit Growth | -61.9% | -262.0% | -67.2% | -8.2% |

| Operating Margin | 22.9% | 33.6% | 42.3% | 47.4% |

| Fixed Asset Turnover | 0.4 | 0.5 | 0.6 | 0.5 |

| Debt/Equity | 3.9 | 2.5 | 2.2 | 1.7 |

| Debt/Assets | 51.8% | 54.4% | 50.4% | 43.8% |

| Interest Coverage (Times) | -0.9 | 4.2 | 2.1 | 2.4 |

| Return on Equity | -52.1% | 45.7% | 13.0% | 10.9% |

| Return on Capital Employed | -4.8% | 19.0% | 10.2% | 12.3% |

| Free Cash Flow (Rs Cr) | 361 | -380 | 3,870 | 2,722 |

- Price-to-Earnings (P/E) Ratio: The current P/E ratio is 80.0, which is high compared to the industry P/E of 49.8, indicating potential overvaluation.

- Price-to-Book (P/B) Ratio: To evaluate the market’s valuation of the company’s book value.

- Debt-to-Equity Ratio: Improved from 3.9 in Mar-21 to 1.7 in Mar-24, indicating reduced financial leverage and a stronger equity base.

- partnerships and technological advancements can drive future revenue.

Key Observations:

- Revenue and Profitability: The company has demonstrated robust sales growth with improving profitability, albeit with significant fluctuations in net profit.

- Expense Management: Effective management of employee costs and selling expenses, but notable increases in other expenses in Mar-24 need attention.

- Debt Management: Reduction in debt levels and improved debt-to-equity ratio highlight better financial leverage management.

- Asset Growth: Steady growth in assets and significant investments in fixed assets indicate long-term growth strategy.

- Cash Flow Variability: Fluctuating free cash flow suggests varying operational efficiency and investment strategies.

- Key Ratios: Improvement in operating margins and returns on equity and capital employed reflect enhanced operational efficiency and profitability.

2. Technical Analysis

This is stock is reletively very new so now clear Technical analysis can be done on same

3. Industry and Market Analysis

A. Industry Trends:

- Evaluate the telecommunications industry trends such as 5G deployment, digital transformation, and regulatory environment.

B. Competitive Analysis:

- Analyze Bharti Hexacom’s position relative to competitors in terms of market share, service offerings, and technological advancements.

C. Macroeconomic Factors:

- Consider the impact of macroeconomic factors such as GDP growth, interest rates, and inflation on the telecommunications sector.

4. Sentiment Analysis

A. News and Media Sentiment:

- Use sentiment analysis tools to quantify the positive or negative sentiment surrounding Bharti Hexacom.

B. Investor Sentiment:

- Analyze investor sentiment through surveys, forums, and trading volumes.

5. Modeling and Forecasting

A. Statistical Models:

- Time Series Analysis: Utilize ARIMA (AutoRegressive Integrated Moving Average) models to forecast future prices based on historical data.

- Regression Analysis: Build regression models to identify relationships between share price and various predictor variables (e.g., earnings, interest rates).

B. Machine Learning Models:

- Supervised Learning: Use algorithms like Linear Regression, Decision Trees, and Support Vector Machines (SVM) for prediction.

- Neural Networks: Implement deep learning models for complex pattern recognition and prediction.

C. Scenario Analysis:

- Develop different scenarios (e.g., best-case, worst-case, base-case) based on various assumptions and predict the share price under each scenario.

6. Evaluation and Adjustment

A. Continuous Monitoring:

- Continuously monitor the performance of the predictive models and adjust them based on new data and changing market conditions.

B. Expert Reviews:

- Incorporate insights from industry experts and financial analysts to refine predictio

- Financial Performance: Sustained revenue growth, robust profit margins, and efficient debt management will bolster investor confidence.

- Industry Positioning: Strong market presence, strategic partnerships, and innovative service offerings enhance the company’s competitive edge.

- Technological Advancements: Adoption of advanced technologies and 5G deployment provide significant growth impetus.

Expert Analysis: Key Reasons Why Jefferies Expects 19% More Gains for Bharti Hexacom

Jefferies expects Bharti Hexacom to see a 19% increase in its share price due to four key factors: strong growth outlook, margin gains, strong free cash flow generation, and lower capital intensity driving higher Returns on Capital Employed (ROCE).

Strong Growth Outlook: Bharti Hexacom is set for significant growth, operating in markets with lower tele-density and benefiting from tariff hikes translating into higher ARPUs. Jefferies projects a 16% CAGR in revenues over FY24–27, driven by a 12% CAGR in ARPU and a 4% CAGR in mobile customers.

Healthy Margin Expansion: Jefferies forecasts a 600bps increase in margins to 53% by FY27, with incremental EBITDA margins of 64%, resulting in a 21% EBITDA CAGR.

Free Cash Flow Generation and Lower Capital Intensity: Strong free cash flow generation and lower capital intensity are expected to enhance Bharti Hexacom’s ROCE, enabling reinvestment in growth opportunities without excessive capital expenditure.

Read more: Bharti Hexacom share price gains 7% as Jefferies initiates coverage and sees 19% upside

Investment Considerations

Investors should consider the following before investing in Bharti Hexacom’s shares:

- Risk Factors: Potential risks include regulatory changes, market competition, and technological disruptions.

- Growth Potential: The company’s strategic initiatives and industry trends indicate strong growth potential.

- Valuation Metrics: Analyzing key valuation metrics such as P/E ratio, EV/EBITDA, and price-to-book ratio provides insights into the share’s fair value.

Conclusion

Bharti Hexacom’s upcoming IPO presents a promising investment opportunity in the Indian telecommunications sector. With a strong financial track record, competitive market position, and favorable industry trends, the company’s share price target looks optimistic. Investors should conduct thorough due diligence, considering both potential risks and growth prospects, to make informed investment decisions.

FAQs related to Bharti Hexacom Limited

1. Why should I consider investing in Bharti Hexacom? Bharti Hexacom is a leading player in the telecommunications sector, showing consistent financial growth and strong market positioning. Its strategic focus on expanding network coverage and adopting innovative technologies makes it a promising investment.

2. How has Bharti Hexacom performed financially in recent years? Bharti Hexacom has demonstrated stable revenue growth and profit margins, effectively managing its debt and maintaining a strong financial position.

3. What are the key risks associated with investing in Bharti Hexacom? Key risks include regulatory changes, market competition, and economic fluctuations. However, Bharti Hexacom’s strong market presence and innovative strategies mitigate these risks.

4. What are Bharti Hexacom’s future growth prospects? Bharti Hexacom’s future growth prospects are strong, driven by ongoing and planned telecommunications projects, technological advancements, and supportive government policies.

5. How do government policies impact Bharti Hexacom’s growth? Supportive government policies, including increased budget allocations for telecommunications and incentives for infrastructure development, create a favorable environment for Bharti Hexacom’s growth and profitability.

6. What is Bharti Hexacom’s share price target for 2024? The share price target for 2024 is projected to have a base target of ₹180, with a lower target of ₹170 and an upper target of ₹190.

References and Sources

For accurate and up-to-date information, refer to the following sources:

- Bharti Hexacom Official Website

- Securities and Exchange Board of India (SEBI)

- National Stock Exchange of India (NSE)

- Bombay Stock Exchange (BSE)

Disclaimer

The information provided in this blog is for educational and informational purposes only. It is not intended as investment advice and should not be construed as such. The share price targets and projections are based on historical data, market trends, and expert analysis. However, all investments carry inherent risks, and past performance is not indicative of future results. Before making any investment decisions, it is important to conduct your own research and consult with a qualified financial advisor.

The author and publisher of this blog are not responsible for any losses or damages that may occur as a result of the use or reliance on this information. Always consider your financial situation, risk tolerance, and investment objectives before making any investment decisions.